Delta State Launches N1 Billion MSME Loan Program

Delta State Government Announces N1 Billion MSME Loan Initiative

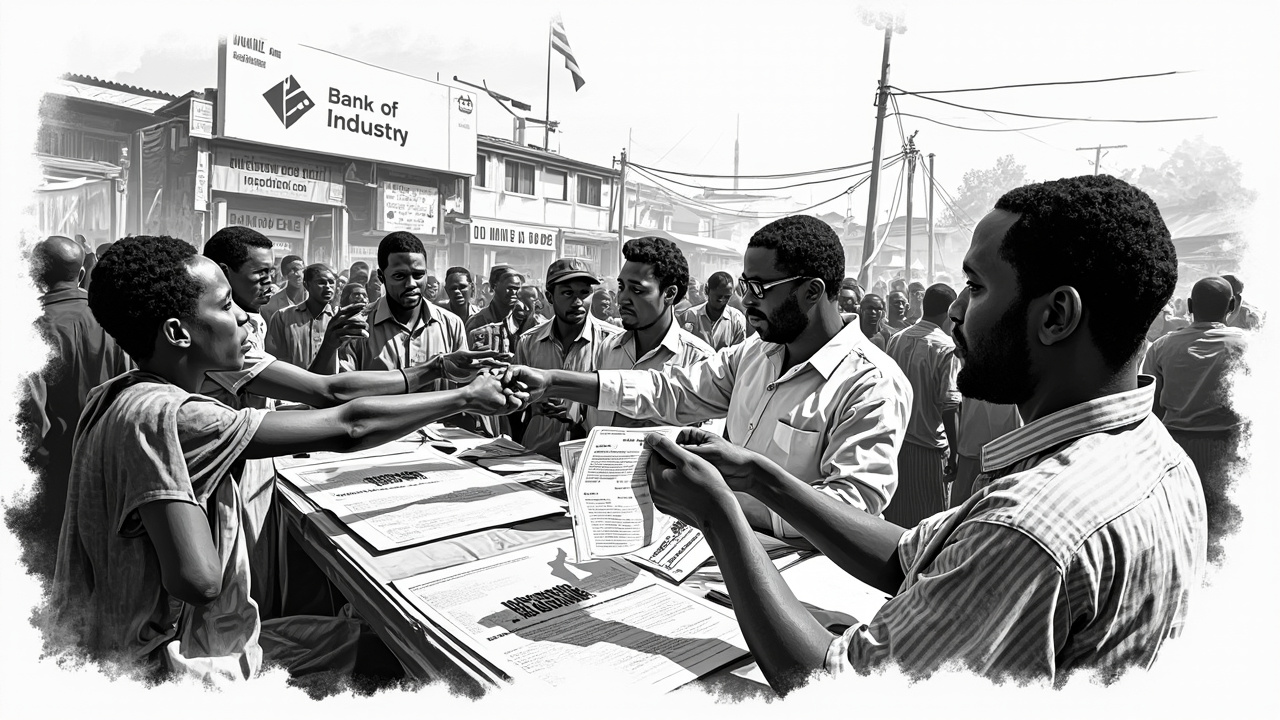

The Delta State Government has launched a N1 billion revolving loan program for micro, small, and medium enterprises (MSMEs). The Bank of Industry will manage the funds. Governor Sheriff Oborevwori announced the program on October 15, 2024. The initiative aims to boost local businesses and create jobs across the state.

How the Loan Program Will Operate

The Bank of Industry will administer the N1 billion fund. The program offers loans with competitive interest rates. MSMEs in Delta State can apply through the Bank of Industry's portal. The government designed the fund as revolving. This means repaid loans will replenish the pool for new borrowers. The program targets sectors like agriculture, manufacturing, and services. Eligible businesses must meet specific criteria. They need a valid business registration with the Corporate Affairs Commission. Applicants must also provide a viable business plan.

Why It Matters

This loan program matters for Delta State's economy. MSMEs form the backbone of Nigeria's business landscape. They account for over 90% of businesses in the country. These enterprises contribute nearly 50% to Nigeria's GDP. They also provide about 84% of employment. Yet MSMEs often struggle to access finance. Only 30% of small businesses in Nigeria secure formal loans. High interest rates and collateral requirements block many entrepreneurs. The Delta State program addresses this gap. It offers affordable capital to fuel growth. The revolving structure ensures sustainability. Successful businesses can repay and free funds for others. This creates a cycle of investment and development.

Economic Context and Challenges

Delta State faces economic pressures. Nigeria's inflation rate hit 28.9% in December 2023. Food prices rose by 33.9% in the same period. These conditions squeeze small businesses. Many MSMEs operate on thin margins. They need working capital to survive and expand. The state government recognizes this urgency. The N1 billion injection provides immediate relief. It also signals commitment to private sector growth. Previous state initiatives show mixed results. The Edo State government launched a N1 billion MSME fund in 2022. It reported disbursing N650 million to 500 businesses by 2023. The Lagos State Employment Trust Fund has supported over 15,000 businesses since 2016. These examples highlight both potential and pitfalls. Effective management determines success. The Bank of Industry brings experience. It has managed similar funds in other states.

What Businesses Should Watch

MSMEs in Delta State should monitor several factors. First, watch the application timeline. The government will announce specific dates soon. Prepare documents early. These include tax clearance certificates and bank statements. Second, track interest rates and terms. The Bank of Industry will publish detailed guidelines. Compare these with other financing options. Third, observe repayment schedules. The revolving nature depends on timely repayments. Defaults could shrink the fund. Fourth, note sector priorities. The program may favor certain industries. Agriculture and tech often receive emphasis. Align your business plan accordingly. Fifth, watch for training components. Some programs include capacity building. This can enhance your chances of approval and success.

Implementation and Oversight

The Bank of Industry will handle day-to-day operations. It will screen applications and disburse loans. The Delta State Ministry of Commerce and Industry will provide oversight. The ministry will ensure funds reach intended beneficiaries. Transparency measures include regular audits. The government will publish quarterly reports on disbursements. This accountability builds trust. It also helps refine the program over time. The Bank of Industry uses a digital platform for applications. This reduces paperwork and speeds processing. Businesses can track their status online. The system also allows for feedback and complaints.

Potential Impact on Local Markets

The N1 billion loan program could stimulate Delta State's economy. It may increase business activity in cities like Warri and Asaba. More capital means more inventory, equipment, and hiring. This boosts local supply chains. For example, a bakery that gets a loan can buy more flour from local mills. A fashion designer can purchase more fabrics from nearby markets. The multiplier effect spreads benefits. Each Naira lent can generate several Naira in economic activity. The program also promotes financial inclusion. Many MSMEs operate informally. Access to formal credit brings them into the regulated economy. This improves tax compliance and data collection. It also helps businesses build credit histories for future borrowing.

Challenges and Risks

The program faces several risks. First, loan defaults could deplete the revolving fund. The Bank of Industry must enforce strict repayment terms. Second, bureaucratic delays might slow disbursement. Past programs in Nigeria have suffered from slow execution. Third, inflation may erode the fund's value. N1 billion today buys less than it did a year ago. The government might need to top up the fund periodically. Fourth, targeting the right businesses is crucial. Loans should go to viable enterprises with growth potential. Fifth, corruption could divert funds. Strong oversight mechanisms are essential. The Bank of Industry has anti-fraud protocols. These include background checks and random audits.

Looking Ahead

The Delta State government plans to review the program after one year. It will assess metrics like jobs created and revenue generated. Success could lead to additional funding. Other states may replicate the model. The federal government also supports MSMEs through the Central Bank of Nigeria. Programs like the Anchor Borrowers' Scheme have disbursed over N1 trillion since 2015. The Delta initiative complements these efforts. It focuses on local needs and conditions. The coming months will show initial results. The first loans should reach businesses by early 2025. Their performance will guide future policy. The ultimate goal is a thriving private sector that drives sustainable development.