Moroccan Lamb Prices Surge as Imported Beef Gains Market Share

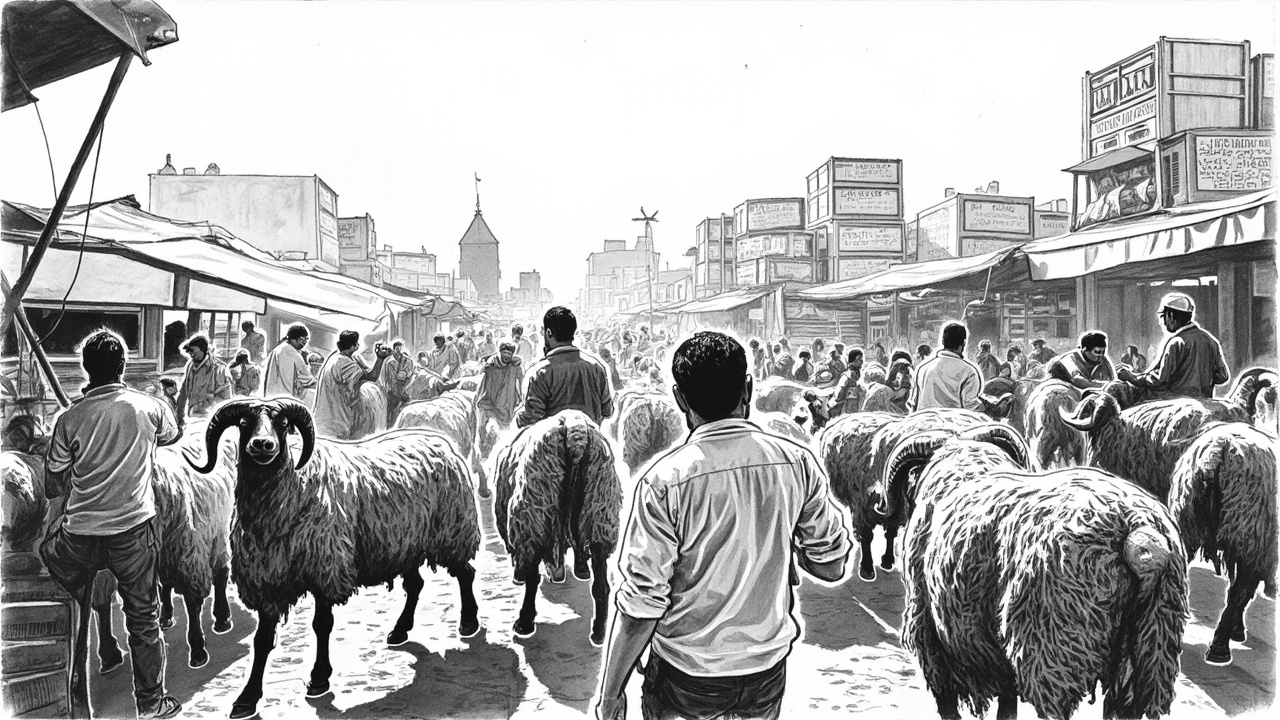

Lamb Prices Jump Sharply in Casablanca

Lamb prices in Morocco's wholesale markets have surged dramatically in recent days. According to https://lematin.ma, Hicham Jawabri, the regional secretary general of wholesale red meat traders in Casablanca, reported the spike. Jawabri said prices for live sheep increased significantly within just a few days. The source did not provide specific percentage increases or exact dates for the price movement. This sudden inflation affects both traders and consumers across Morocco's largest economic center.

Imported Beef Makes Market Inroads

Simultaneously, imported beef is gaining ground in the Moroccan market. The source indicates this imported product is capturing more market share. This development creates a dual dynamic in Morocco's red meat sector. Domestic lamb faces price pressures while foreign beef expands its presence. The exact origins of the imported beef and specific market share data were not detailed in the source report.

Market Reactions and Consumer Impact

Wholesale traders in Casablanca are navigating these shifting conditions. Higher lamb prices squeeze profit margins for businesses that rely on domestic supply. Consumers face increased costs for traditional lamb dishes during a period of economic pressure. Imported beef offers a potentially cheaper alternative for price-sensitive buyers. The source did not specify how restaurants, supermarkets, or individual consumers are responding to these changes.

Why It Matters

Morocco's red meat market directly impacts food security and inflation. The National Food Safety Office (ONSSA) monitors meat imports and domestic production. Price volatility affects household budgets across income levels. Import dependency raises questions about trade balances and local agriculture support. These market shifts could influence government policy on tariffs, subsidies, or import quotas.

What Businesses Should Watch

Monitor ONSSA announcements about import regulations and health certifications. Track exchange rate fluctuations that affect import costs. Watch for Moroccan Ministry of Agriculture initiatives to support local livestock farmers. Observe consumer spending patterns during upcoming religious festivals when meat consumption typically peaks. The source did not indicate when price data might be updated or what specific indicators traders are monitoring.

Government Context and Regulatory Framework

Morocco's government manages meat imports through specific agencies. The Ministry of Agriculture, Maritime Fisheries, Rural Development and Water and Forests sets agricultural policy. ONSSA controls sanitary standards for all meat products. The Ministry of Economy and Finance oversees customs duties and trade agreements. Businesses must comply with these overlapping regulatory requirements.

Economic Statistics and Market Data

Morocco imported approximately 130,000 tons of beef and veal in 2022, according to USDA Foreign Agricultural Service data. The country's total meat consumption reached 1.4 million tons in 2021, reports the Moroccan Ministry of Agriculture. Food inflation in Morocco averaged 5.2% in 2023, according to the High Commission for Planning. These figures provide context for the current market developments.

Missing Information and Next Steps

The source article did not provide specific price percentages for the lamb increase. It did not name the countries supplying imported beef to Morocco. No government official statements or policy responses were included. No data on wholesale versus retail price differentials appeared. Businesses should watch for official price indices from the High Commission for Planning. They should monitor ONSSA import authorization lists for new suppliers. They should track announcements from the Moroccan Interprofessional Federation of Red Meat (FIVIAR) about market conditions.