Kenya Minimum Wage 2026: Rates, Calculator, Compliance Guide

Kenya's minimum wage will change in 2026. Business owners must prepare now. This guide explains the new rates, provides a salary calculator, and details employer compliance steps. We cover specific costs, timelines, and practical examples for entrepreneurs, investors, and expats.

Kenya's 2026 Minimum Wage Rates

The Ministry of Labour and Social Protection sets Kenya's minimum wage. In 2025, the minimum wage for general workers in major cities was KES 15,201 monthly (about $115 USD). Expect a 5-8% increase for 2026. The exact 2026 rates will be announced in May 2026. Rates vary by sector and location. For example, agricultural workers earn less than urban general workers. The 2026 adjustment will reflect inflation and economic growth. Kenya's inflation averaged 6.2% in 2024, according to the Kenya National Bureau of Statistics. The Central Bank of Kenya projects 5.5% inflation for 2025. Minimum wage increases typically match or exceed inflation. Prepare for urban general rates around KES 16,000-16,500 monthly ($120-125 USD) in 2026. Review the official gazette notice from the Ministry of Labour in May 2026 for exact figures.

Simple Salary Calculator for 2026

Use this calculator to estimate 2026 payroll costs. First, determine the employee's category. Categories include general worker, agricultural worker, or domestic worker. Second, check the location. Major cities like Nairobi and Mombasa have higher rates. Third, apply the 2026 rate. Assume a 7% increase from 2025 rates for planning. Example: A general worker in Nairobi earned KES 15,201 monthly in 2025. With a 7% increase, the 2026 rate would be KES 16,265 monthly. Convert to USD at current exchange rates (KES 132 = $1 USD). That equals about $123 USD monthly. Calculate annual costs by multiplying by 12. Add statutory deductions like PAYE tax and NSSF contributions. The Kenya Revenue Authority (KRA) requires PAYE on incomes above KES 24,000 monthly. Use the KRA iTax platform for accurate calculations. Update your payroll software by June 2026. Companies like Safaricom use automated systems for compliance.

Step-by-Step Employer Compliance Guide

Follow these steps to comply with Kenya's 2026 minimum wage laws. Step 1: Monitor official announcements. The Ministry of Labour publishes new rates in the Kenya Gazette in May 2026. Subscribe to updates via their website. Step 2: Adjust payroll systems. Update all employee contracts and payroll software by July 1, 2026. The new rates take effect on July 1 each year. Step 3: Communicate changes to employees. Notify staff in writing about the new rates. Explain any changes in payslips. Step 4: Pay the correct amounts. Ensure all employees receive at least the minimum wage for their category and location. Include allowances like housing if applicable. Step 5: Maintain records. Keep payroll records for at least five years. The Ministry of Labour may inspect these records. Step 6: Report to authorities. File monthly returns with the KRA and NSSF. Use the iTax system for tax filings. Non-compliance risks fines up to KES 100,000 ($758 USD) per violation. The Ministry of Labour conducted 12,000 inspections in 2024, issuing 500 fines. Plan your budget now for the 2026 increases.

Costs and Financial Planning for 2026

Budget for higher labor costs in 2026. Estimate a 5-8% increase in wage expenses. For a business with 10 general workers in Nairobi, current monthly wages total KES 152,010 ($1,152 USD). With a 7% increase, 2026 monthly wages will be KES 162,650 ($1,232 USD). That is an extra KES 10,640 monthly ($81 USD). Annually, this adds KES 127,680 ($967 USD). Include statutory costs. NSSF contributions are 6% of wages, split between employer and employee. NHIF deductions also apply. Use the KRA tax bands to calculate PAYE. For example, income up to KES 24,000 monthly is tax-free. Income from KES 24,001 to KES 32,333 pays 10% tax. Plan for these increases in your 2026 financial forecasts. Companies like Equity Bank offer business loans for operational costs. Apply for financing early if needed. The Central Bank of Kenya reports average lending rates of 13% in 2024.

Legal Requirements and Penalties

Kenya's Employment Act, 2007 governs minimum wage compliance. Employers must pay at least the gazetted minimum wage. The Act covers all workers except those in armed forces. Violations lead to penalties. The Ministry of Labour can fine employers up to KES 100,000 ($758 USD) per underpaid worker. Repeat offenders face higher fines or imprisonment. Employees can report violations to labour officers. The Ministry resolved 8,000 wage disputes in 2024. Ensure you follow all rules. Obtain a business license from the county government. Register with the KRA for tax purposes. File annual returns with the Registrar of Companies. Keep records of wages paid for inspection. Use certified payroll systems like those from Oracle or SAP. These systems help avoid errors. Train your HR staff on the 2026 changes. Attend workshops by the Federation of Kenya Employers (FKE). The FKE provides compliance guides and updates.

Impact on Businesses and Investment

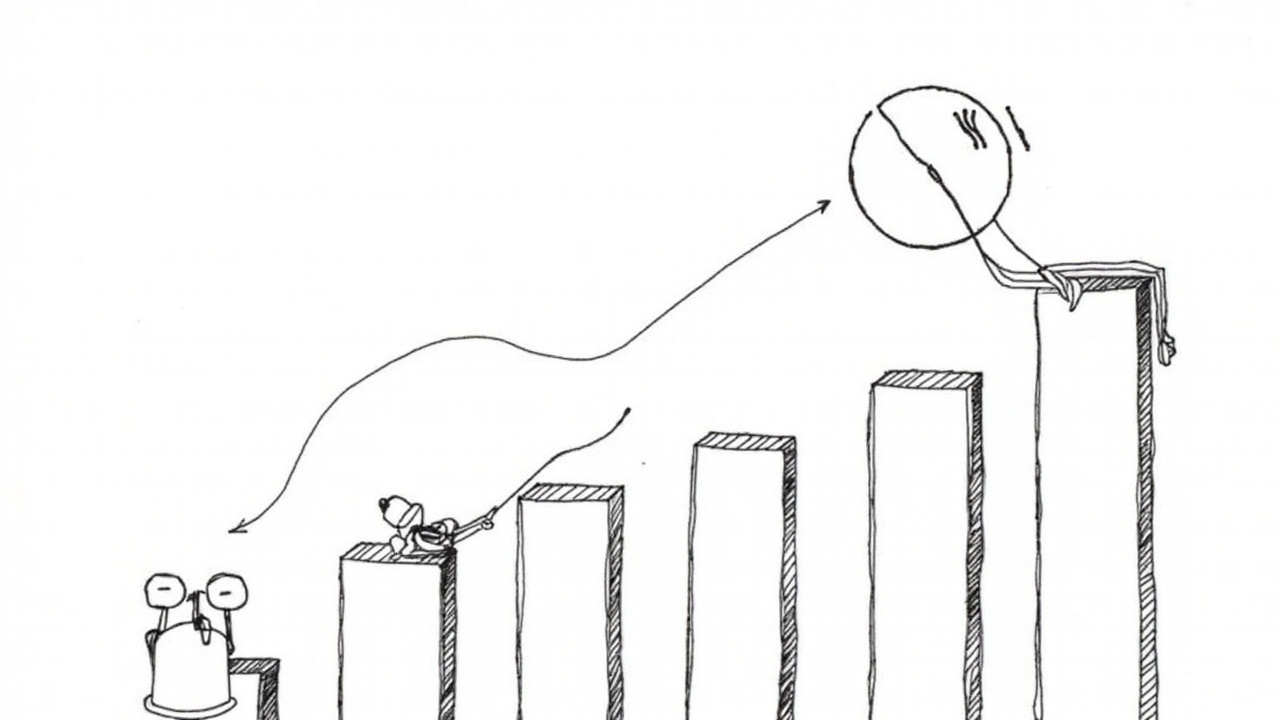

The 2026 minimum wage increase affects business operations. Labor costs will rise for many companies. This may impact profitability in low-margin sectors. For example, retail and hospitality businesses face higher expenses. Companies like Naivas Supermarket may adjust prices. Investors should factor this into market analysis. Higher wages can boost consumer spending. This benefits sectors like fintech and e-commerce. M-Pesa reported increased transaction volumes after past wage hikes. The Nairobi Securities Exchange (NSE) shows mixed reactions to wage changes. Some stocks dip initially, then recover. Monitor companies like Safaricom (NSE: SCOM) and Equity Group (NSE: EQTY) for trends. Expat entrepreneurs must budget for local staff costs. Use the salary calculator in this guide. Consider outsourcing to regions with lower rates. Counties like Kisumu have lower minimum wages than Nairobi. Plan your business model accordingly. The Kenya Investment Authority (KenInvest) offers guidance for foreign investors.

Practical Examples and Case Studies

Here are real-world examples of handling minimum wage changes. Example 1: A Nairobi restaurant with 15 staff. In 2025, monthly wage bill was KES 228,015 ($1,728 USD). For 2026, they budget a 7% increase to KES 243,975 ($1,849 USD). They plan to raise menu prices by 5% to cover costs. Example 2: A tech startup in Mombasa with 20 developers. They pay above minimum wage, so the change has less impact. They use QuickBooks for payroll automation. Example 3: An agricultural exporter in Nakuru. They employ 50 farm workers at lower agricultural rates. They will increase wages by 5% in 2026, adding KES 50,000 monthly ($379 USD) to costs. They apply for an agricultural subsidy from the Ministry of Agriculture. These examples show varied strategies. Learn from companies like Twiga Foods, which manages a large workforce. Twiga uses digital tools for compliance. Adapt these practices to your business.

FAQ on Kenya Minimum Wage 2026

When will the 2026 minimum wage be announced? The Ministry of Labour announces new rates in May 2026. They take effect on July 1, 2026. How do I calculate the new wage for my employees? Use the salary calculator in this guide. Apply the 2026 rate based on employee category and location. What happens if I don't comply? You may face fines up to KES 100,000 per violation. The Ministry of Labour can also take legal action. Are there exemptions to the minimum wage? Some sectors like domestic work have lower rates. Check the gazette notice for specifics. How does this affect foreign investors? Budget for higher labor costs. Consult with KenInvest for support. Use local payroll services for compliance. Can I reduce staff to manage costs? Yes, but follow labour laws on termination. Provide notice and severance pay as required. Where can I get official updates? Visit the Ministry of Labour website or subscribe to the Kenya Gazette.

Prepare now for Kenya's 2026 minimum wage changes. Review the new rates in May 2026. Update your payroll systems by July. Budget for increased costs of 5-8%. Use the salary calculator to estimate expenses. Follow the compliance steps to avoid penalties. Monitor official sources for updates. This guide helps entrepreneurs, investors, and business owners navigate the changes. Plan ahead to ensure smooth operations in Kenya's dynamic market.