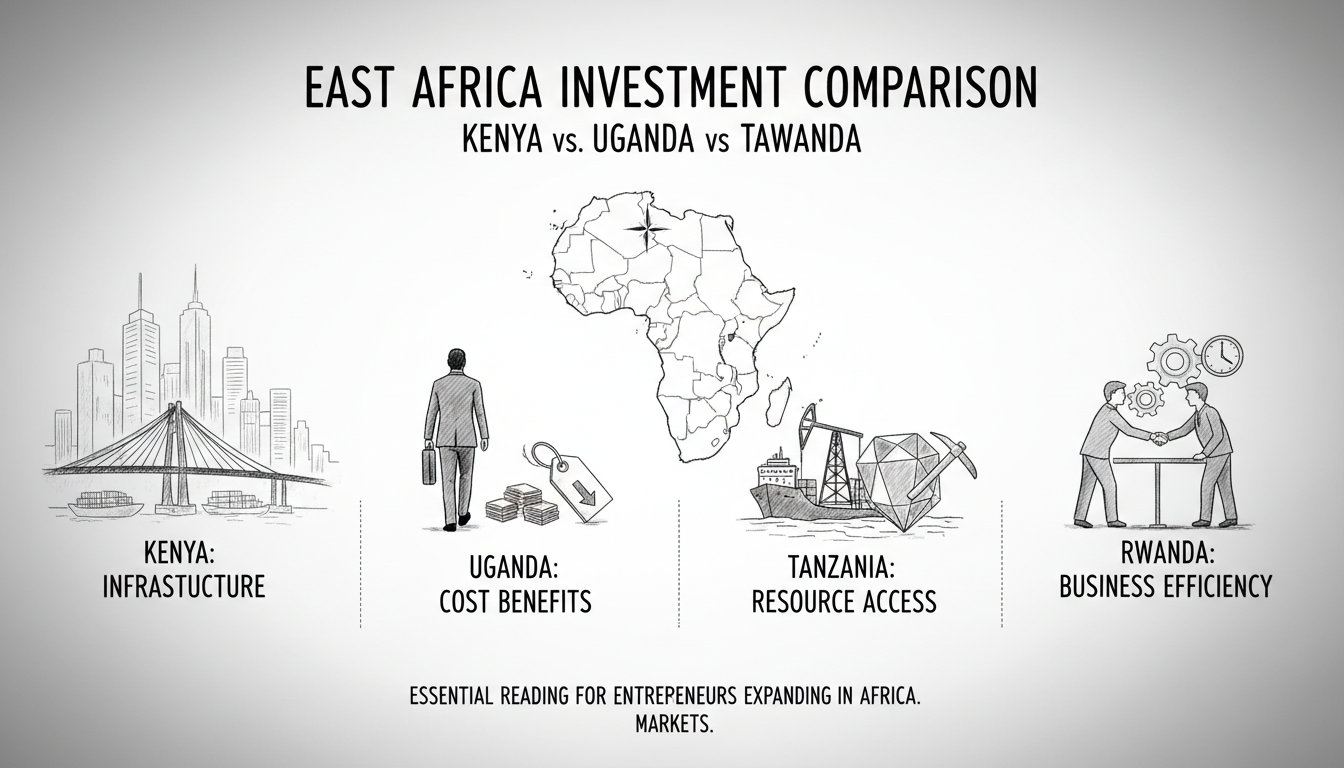

East Africa Investment Comparison: Kenya vs Uganda vs Tanzania vs Rwanda

Introduction

This guide provides a detailed comparison of East Africa's top investment destinations. We examine Kenya, Uganda, Tanzania, and Rwanda side by side. You will discover the hard truths about each market's opportunities and challenges. This analysis helps entrepreneurs and investors make informed decisions about East African expansion.

Understanding these four economies is crucial for business success. Each country offers unique advantages and specific drawbacks. Our comparison uses current data and realistic projections to guide your investment strategy. We focus on practical insights you can apply immediately.

Kenya Business Environment Overview

Kenya maintains East Africa's most developed economy with strong infrastructure. The country leads in technology adoption and financial services innovation. Nairobi serves as the region's commercial hub with international connectivity. Kenya's middle class continues expanding rapidly.

Manufacturing and services dominate Kenya's economic landscape. The country benefits from established supply chains and skilled workforce. Political stability has improved significantly in recent years. Kenya's strategic location provides access to regional markets.

Economic Performance Comparison

Kenya's GDP reached $110 billion in 2025 with 5.5% annual growth. Uganda recorded $45 billion GDP growing at 6.2% annually. Tanzania achieved $85 billion GDP with 6.8% growth rate. Rwanda maintained $13 billion economy expanding at 7.5% yearly.

Inflation rates show important differences between these markets. Kenya maintains 6.5% inflation with moderate price stability. Uganda experiences 7.8% inflation affecting consumer purchasing power. Tanzania controls inflation at 4.2% through careful monetary policy. Rwanda keeps inflation low at 3.9% annually.

Foreign direct investment patterns reveal market preferences. Kenya attracted $1.2 billion FDI in 2025 across multiple sectors. Uganda received $800 million focused on oil and agriculture. Tanzania secured $1.5 billion mainly in natural resources. Rwanda collected $400 million concentrated in technology and services.

Sector-Specific Investment Opportunities

Technology investments favor Kenya with its established startup ecosystem. Companies like Safaricom and Twiga Foods demonstrate sector maturity. Uganda shows promise in agricultural technology and mobile money services. Tanzania offers opportunities in digital payments and e-commerce platforms. Rwanda excels in tech-enabled government services and smart city initiatives.

Manufacturing presents different advantages across these countries. Kenya benefits from established industrial parks and skilled labor. Uganda offers lower production costs and abundant raw materials. Tanzania provides mineral processing opportunities and port access. Rwanda focuses on high-value manufacturing and export processing zones.

Agriculture remains a cornerstone of East African economies. Kenya leads in horticulture exports and dairy production. Uganda dominates in coffee, tea, and food crops. Tanzania excels in cashew nuts, tobacco, and sesame production. Rwanda specializes in coffee and tea for premium markets.

Business Registration and Setup Process

Starting a business in Kenya takes approximately 30 days. You need company registration with the Business Registration Service. Obtain tax identification numbers from Kenya Revenue Authority. Secure necessary licenses from relevant regulatory bodies.

Uganda requires about 25 days for business registration. Register with Uganda Registration Services Bureau first. Apply for investment license from Uganda Investment Authority. Complete tax registration with Uganda Revenue Authority.

Tanzania business setup spans roughly 35 days. Register with Business Registrations and Licensing Agency. Obtain tax clearance certificate from Tanzania Revenue Authority. Secure sector-specific permits from relevant ministries.

Rwanda offers the fastest registration at just 24 hours. Use the Rwanda Development Board one-stop center. Complete all registration steps through their online portal. Receive business registration certificate and tax identification simultaneously.

Costs and Timeline Analysis

Company registration costs vary significantly across these markets. Kenya charges approximately $150 for standard company registration. Uganda requires about $100 for similar business registration. Tanzania demands roughly $200 for comprehensive business setup. Rwanda costs only $50 for complete business registration.

Office space rental shows substantial price differences. Nairobi prime office space costs $25 per square meter monthly. Kampala quality office space averages $18 per square meter. Dar es Salaam commercial space runs about $20 per square meter. Kigali premium offices charge $22 per square meter.

Minimum capital requirements affect startup decisions. Kenya eliminated minimum capital for most business types. Uganda maintains $1,000 minimum for foreign companies. Tanzania requires $500,000 for mining and certain sectors. Rwanda has no minimum capital requirements for most businesses.

Legal and Regulatory Requirements

Kenya requires work permits for foreign employees costing $2,000 annually. Companies must comply with Kenya Bureau of Standards regulations. Environmental impact assessments needed for manufacturing projects. Labor laws mandate minimum wage and employee benefits.

Uganda demands investment licenses for foreign-owned businesses. Work permits cost approximately $1,500 per year per employee. Companies must register with National Social Security Fund. Tax compliance includes monthly VAT returns and annual filings.

Tanzania requires business licenses renewable annually. Work permits range from $1,000 to $3,000 depending on category. Companies must contribute to social security funds. Special sector regulations apply to mining and tourism.

Rwanda offers combined work and residence permits for $500 annually. Business licensing follows simplified online procedures. Tax compliance includes electronic filing and payments. Labor regulations emphasize employee protection and fair wages.

Infrastructure and Logistics Assessment

Kenya boasts East Africa's most developed infrastructure network. The country has extensive road networks and railway connections. Mombasa port serves as the region's primary trade gateway. Jomo Kenyatta International Airport provides global connectivity.

Uganda relies on Kenyan infrastructure for international trade. The country improves internal road networks gradually. Entebbe Airport serves as the main international gateway. Railway connections to Kenya facilitate regional trade.

Tanzania develops alternative trade routes through Dar es Salaam. The port handles increasing volumes of regional cargo. Julius Nyerere International Airport expands international routes. Internal transportation networks require continued investment.

Rwanda invests heavily in technology infrastructure. The country develops Kigali as a modern business hub. Road networks connect efficiently to neighboring countries. Bugesera International Airport project enhances air connectivity.

Market Access and Regional Integration

Kenya participates actively in East African Community trade agreements. The country benefits from Common Market Protocol provisions. Kenyan companies access markets across six member states. Regional headquarters in Nairobi serve multiple countries.

Uganda leverages its central location within East Africa. The country accesses markets in DR Congo and South Sudan. Uganda benefits from East African Community tariff reductions. Cross-border trade with Kenya remains substantial.

Tanzania offers access to SADC markets through its membership. The country serves as gateway to southern African markets. Tanzania's ports handle landlocked neighbors' trade. Multiple trade agreements provide market diversification.

Rwanda positions as a regional hub for services and technology. The country attracts headquarters for international organizations. Rwanda benefits from African Continental Free Trade Area. Strategic location enables serving multiple regional markets.

Labor Market and Skills Availability

Kenya provides East Africa's largest skilled workforce. Universities produce thousands of graduates annually. Technical training institutions supply vocational skills. Labor costs remain competitive for skilled professionals.

Uganda offers lower labor costs with adequate basic skills. The country focuses on agricultural and technical training. English proficiency supports business operations. Workforce availability meets most industry needs.

Tanzania supplies labor across various skill levels. Vocational training expands technical capabilities. Swahili dominance requires language adaptation for international firms. Manufacturing sector benefits from available workforce.

Rwanda emphasizes education and skills development. The workforce shows strong technology adoption capability. English and French proficiency supports international business. Government prioritizes quality education system.

Taxation and Incentives Comparison

Kenya corporate tax rate stands at 30% for resident companies. Value Added Tax applies at 16% on most goods and services. Special Economic Zones offer tax holidays and reduced rates. Manufacturing sector benefits from investment deductions.

Uganda charges 30% corporate tax for most businesses. VAT rate of 18% applies to taxable supplies. Investment incentives include tax holidays for priority sectors. Manufacturing in parks enjoys reduced tax rates.

Tanzania maintains 30% corporate income tax rate. VAT charges 18% on standard taxable supplies. Mining sector faces higher tax rates and royalties. Export processing zones provide tax exemptions.

Rwanda offers competitive 28% corporate tax rate. VAT applies at 18% with simplified compliance. Special economic zones provide tax holidays up to 10 years. Technology companies benefit from reduced tax rates.

Tips and Best Practices

Conduct thorough market research before selecting your location. Visit each country personally to assess business environment. Network with local business associations and chambers. Understand cultural differences and business customs.

Build relationships with local partners and suppliers. Develop contingency plans for political or economic changes. Monitor currency fluctuations and hedging options. Maintain compliance with all regulatory requirements.

Hire local professionals for legal and accounting services. Implement strong internal controls and audit systems. Develop local management talent for sustainable operations. Establish clear communication channels with authorities.

Common Mistakes to Avoid

Do not underestimate infrastructure challenges in some locations. Avoid assuming uniform business practices across countries. Never ignore local partnership requirements in regulated sectors. Do not neglect community engagement and social responsibility.

Avoid poor due diligence on potential local partners. Never underestimate licensing and permit timelines. Do not ignore cultural sensitivity in business operations. Avoid inadequate capital planning for startup phases.

FAQ Section

Which country offers the best infrastructure for manufacturing? Kenya provides the most developed infrastructure with reliable utilities and transport networks. The country has established industrial parks and skilled workforce.

Where can I find the most favorable tax incentives? Rwanda offers attractive tax holidays and reduced rates in special economic zones. The country provides streamlined tax compliance procedures.

Which market has the largest consumer base? Kenya boasts the largest middle class and urban population. Consumer spending power continues growing steadily.

How stable are the political environments? Rwanda maintains high political stability with consistent policies. Kenya shows improved stability in recent years.

What about language barriers for English speakers? Kenya and Uganda use English as official language. Tanzania and Rwanda require some local language adaptation.

Which country processes business registration fastest? Rwanda completes business registration within 24 hours online. Other countries require several weeks for full compliance.

Are there restrictions on foreign ownership? Most sectors allow full foreign ownership across these countries. Some strategic sectors may have ownership limitations.

Conclusion

East Africa presents diverse investment opportunities across four key markets. Kenya leads in infrastructure and market size. Uganda offers lower costs and agricultural potential. Tanzania provides resource access and regional connectivity. Rwanda excels in governance and business efficiency.

Your investment decision should align with specific business needs and risk tolerance. Consider conducting pilot projects before major commitments. Build local partnerships to navigate regulatory environments successfully. East Africa's growth trajectory offers substantial returns for informed investors.