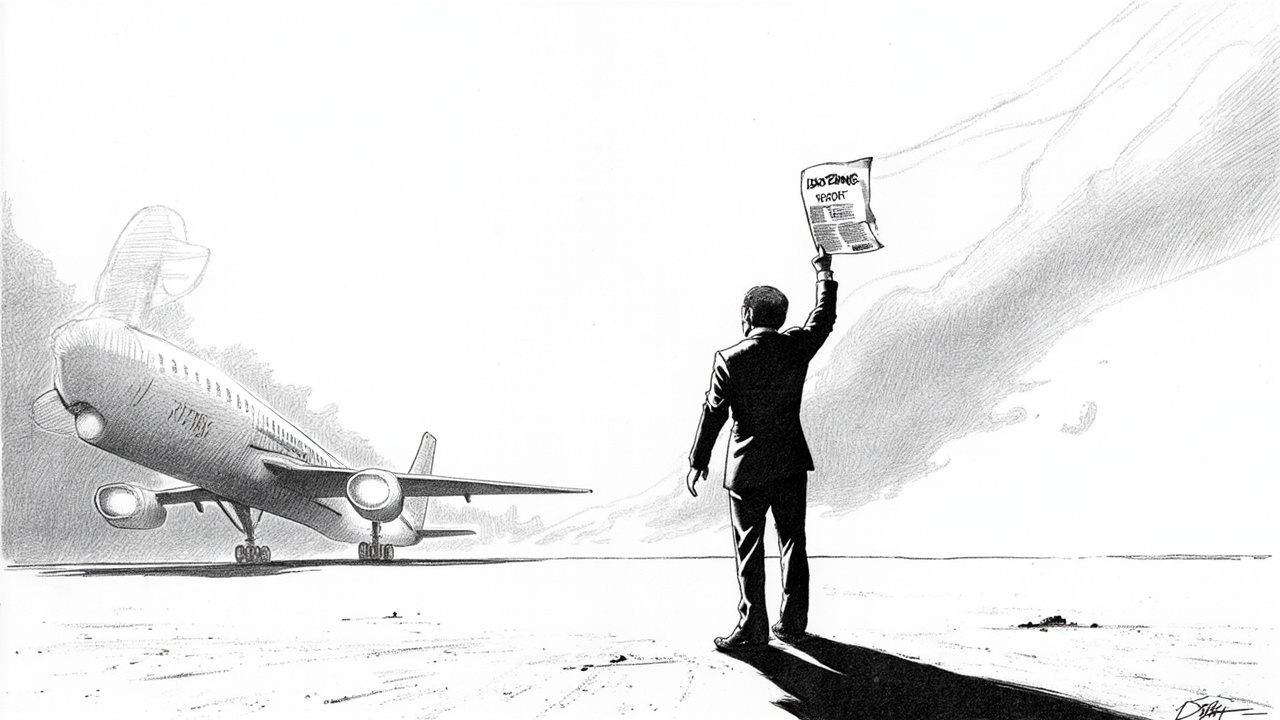

Boeing Flaw Known Before UPS Crash, Safety Board Reveals

Boeing Knew of Structural Flaw Before UPS Crash

The National Transportation Safety Board (NTSB) has determined that Boeing identified a structural flaw in MD-11F aircraft 15 years before a UPS freighter crashed in Kentucky in November. The MD-11F operated by UPS crashed after one of its engines separated from the wing during flight preparation. Investigators found the same flaw Boeing documented in 2008. The NTSB report states Boeing's knowledge of the issue but does not specify if corrective actions were taken. The crash destroyed the aircraft and caused significant damage at the Kentucky airport. No fatalities occurred on the ground, but the incident raised immediate safety concerns. The NTSB investigation took two months to complete its preliminary findings. Boeing and UPS are now reviewing the report's conclusions. The Federal Aviation Administration (FAA) is monitoring the situation for potential regulatory actions.

Why It Matters for Aviation Safety

This revelation challenges Boeing's safety protocols and transparency. The company knew about a critical structural flaw for 15 years. That knowledge preceded a catastrophic engine separation. The NTSB report highlights potential gaps in how manufacturers address known defects. Aviation safety relies on proactive identification and correction of issues. Delays can lead to accidents, as seen in Kentucky. The FAA requires manufacturers to report safety concerns promptly. Boeing's handling of this flaw may trigger stricter oversight. The incident also affects public confidence in air freight. UPS moves over 20 million packages daily globally. Any safety lapse in its fleet could disrupt supply chains. Kenya's aviation sector imports Boeing aircraft and parts. Local airlines like Kenya Airways operate Boeing models. The Kenya Civil Aviation Authority (KCAA) regulates safety standards. It may review Boeing's compliance with international norms. The KCAA issues airworthiness certificates based on manufacturer data. This report could influence future certifications.

Impact on Boeing and Aviation Markets

Boeing faces renewed scrutiny over its safety culture. The company reported $66.6 billion in revenue in 2023. Its commercial airplanes segment generates 40% of that revenue. Boeing's stock (BA) dropped 2% after the NTSB report release. The company has faced previous safety issues, including the 737 MAX grounding. The FAA fined Boeing $2.5 billion in 2021 for compliance failures. This new report may lead to additional penalties. Boeing must now address the MD-11F flaw across its fleet. The company has 150 MD-11 variants still in service worldwide. Corrective actions could cost millions in repairs and inspections. Airlines using these aircraft may face operational delays. UPS operates 10 MD-11F freighters. The company spent $8.9 billion on capital expenditures in 2022. It may need to allocate funds for fleet upgrades. Kenya's aviation market depends on Boeing for aircraft and maintenance. Kenya Airways flies Boeing 787 Dreamliners. The airline ordered 10 new Boeing 737 MAX jets in 2023. Any broader safety concerns could affect delivery timelines. The KCAA requires airlines to maintain strict maintenance records. It conducts annual audits of carriers like Kenya Airways. The authority may increase scrutiny of Boeing-sourced parts.

What Businesses Should Watch

Monitor Boeing's response to the NTSB findings. The company must submit a corrective action plan to the FAA within 30 days. This plan should detail inspections and repairs for affected MD-11F aircraft. Airlines and freight carriers using these planes should prepare for potential groundings. UPS may need to adjust its logistics network. The company handles 5% of global air freight volume. Any fleet disruptions could impact delivery times. Kenya's importers and exporters rely on air freight for perishable goods. Flowers and fresh produce account for 15% of Kenya's exports. Delays could harm agricultural revenues. The KCAA will likely issue a safety directive for Boeing aircraft. Local airlines must comply with any new requirements. This could increase maintenance costs by 10-15%. Investors should watch Boeing's stock performance. The company's credit rating may face pressure from safety issues. Boeing's debt stands at $52 billion as of 2023. Rating agencies like Moody's could downgrade its bonds. Suppliers in Kenya, such as aircraft parts distributors, may see reduced orders. Boeing sources some components from African manufacturers. Any production slowdowns could affect local jobs. The aviation insurance market may raise premiums for Boeing aircraft. Insurers paid $15 billion for aviation claims in 2022. Higher risks could lead to cost increases for airlines. Businesses should diversify supply chains to mitigate air freight risks. Consider alternative carriers or shipping methods for critical goods. Stay informed about FAA and KCAA regulatory updates. These agencies will determine the long-term impact on operations.