Egypt Markets: Elite Education Push Masks Deeper Fiscal Pressures

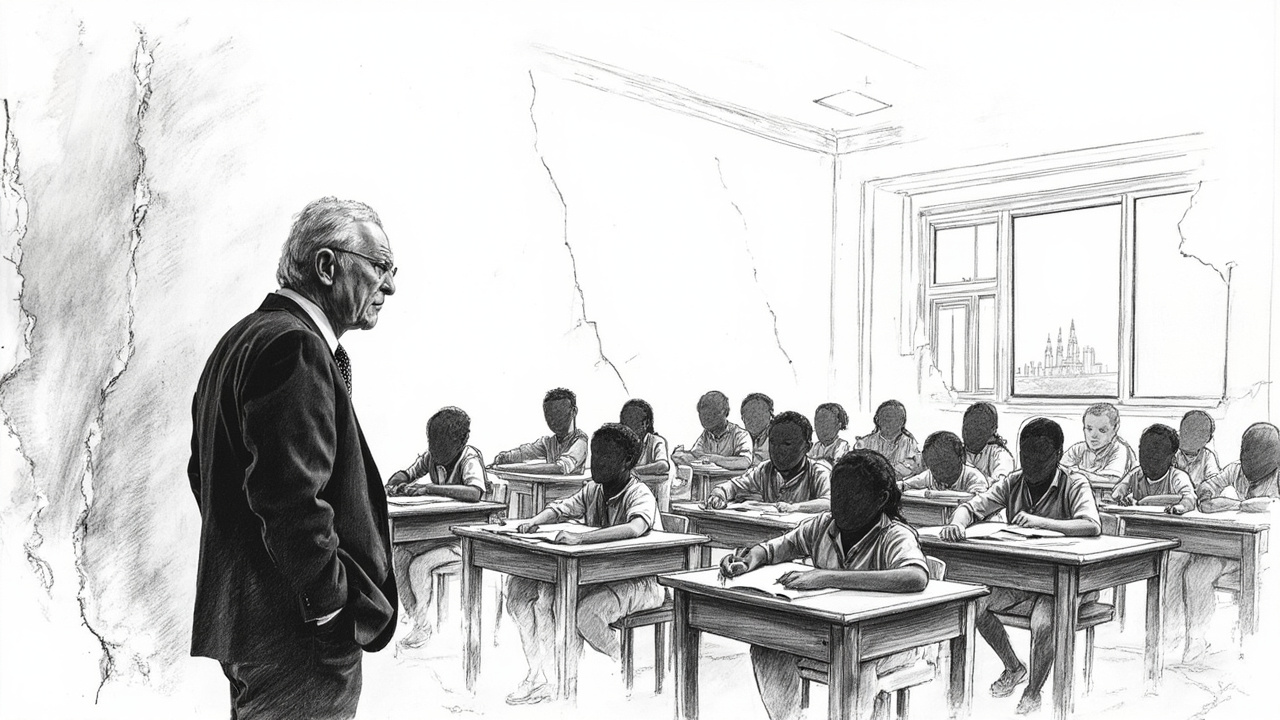

Sir Magdy Yacoub's visit to Manara School in El-Gouna signals more than inspirational messaging. Egypt markets are watching a government desperate to justify massive education spending while debt servicing pressures mount. The timing reveals strategic positioning ahead of inevitable subsidy reforms.

Private Education: The New Fiscal Escape Valve

Egypt's higher education market projects growth from USD 0.78 billion in 2024 to USD 2.13 billion by 2033 at 11.88% CAGR. This suggests the state is quietly engineering an exit from education financing obligations. Public universities serve approximately 3 million students annually across one of the largest higher education systems in North Africa and the Middle East. The risk is obvious: as FX reserves dwindle, education subsidies become unsustainable.

Egyptian Modern Education Systems reported EGP 22.889 million revenues by end-December 2025, up from EGP 19.953 million, despite EGP 2.4 million losses. Private operators are struggling with profitability while the state pushes privatization narratives. Rising population and limited access to quality early education create political tinderboxes. The Higher Education Ministry's rush to finalize online degree regulations with accreditation guidelines exposes desperation to legitimize cost-cutting measures.

The Subsidy Reform Endgame

Celebrity endorsements like Yacoub's visit prepare public opinion for painful transitions. Egypt's education sector underwent "intense transformation" in 2025 to align with future work needs - bureaucratic language for austerity measures. Key e-learning platforms including Nafham, Smart Art Egypt, and Noon Academy position themselves as cheaper alternatives to traditional delivery.

Classera and Skolera control over 60% of K-12 e-learning market share, creating oligopolistic pricing power as public funding retreats. Gender gaps and frequent campus protests constrain growth, but also provide convenient excuses for reducing state commitments. Expect education subsidy cuts within 18 months as Egypt prioritizes debt servicing over social spending.