TADB's Qatar Push Masks Tanzania Markets' Digital Divide

Platform Lock-In Risks Hidden Behind Agricultural Partnerships

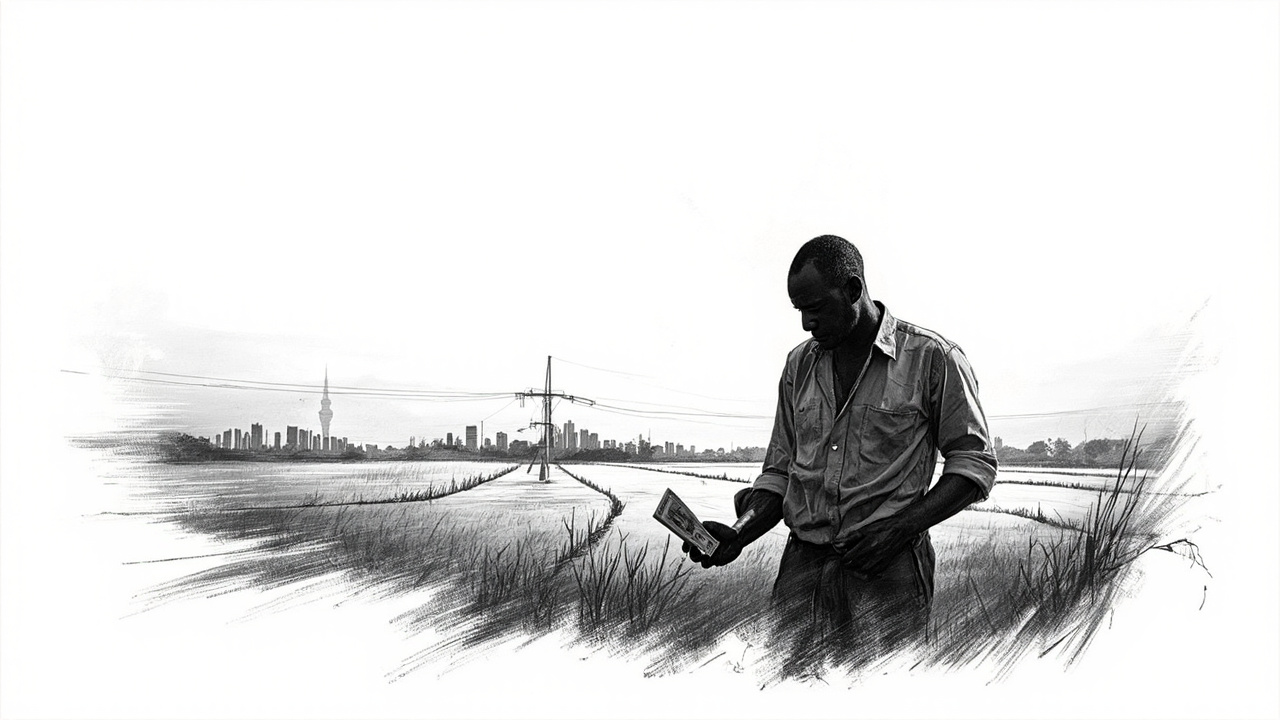

TADB's Qatar exhibition push reveals a deeper structural problem in Tanzania markets. The bank disbursed TSh 378 billion across 800,000 farmers from 2020-2023, but this suggests a concerning pattern: average loan sizes of just $205 per farmer. This micro-fragmentation creates perfect conditions for digital platform dependency.

The risk is clear. When agricultural development banks chase international partnerships, they typically adopt foreign fintech platforms with proprietary data formats. Farmers get locked into subscription models they can't afford long-term. Tanzania's agriculture sector employs over 65% of the labor force, but these workers operate on razor-thin margins in a rain-dependent system. SaaS pricing models designed for Western markets become debt traps.

Consider the timing. TISEZA just allocated 25,000 hectares for a $640 million agro-industrial project, while government expanded irrigation schemes by 156% since 2015. This suggests capital is flowing toward large-scale operations, not the 800,000 small farmers TADB claims to serve. The exhibition narrative masks a classic platform consolidation play.

Customer Churn Inevitable in Rain-Fed Systems

Tanzania's agricultural market projects 5.2% CAGR growth to reach $24.05 billion by 2032, but this assumes consistent farmer adoption of digital services. The reality is harsher. Agriculture still relies heavily on rain-fed systems despite irrigation expansions. When crops fail, subscription payments stop.

Fintech platforms entering through these partnerships will face brutal churn rates. Farmers can't maintain monthly SaaS subscriptions when income depends on seasonal rainfall. Data portability becomes critical when farmers need to switch platforms mid-season, but most agricultural fintech solutions trap data in proprietary formats.

The sector's 26.7% GDP contribution looks impressive until you realize it's spread across subsistence-level operations. This suggests TADB's Qatar partnerships will benefit large agribusiness players like Syngenta and Monsanto, not smallholder farmers.

Expect consolidation within 18 months. Small farmers will abandon expensive digital platforms, leaving TADB with non-performing tech investments and frustrated international partners.