BCEAO Opens Tahoua Branch as Senegal Markets Face Regional Shift

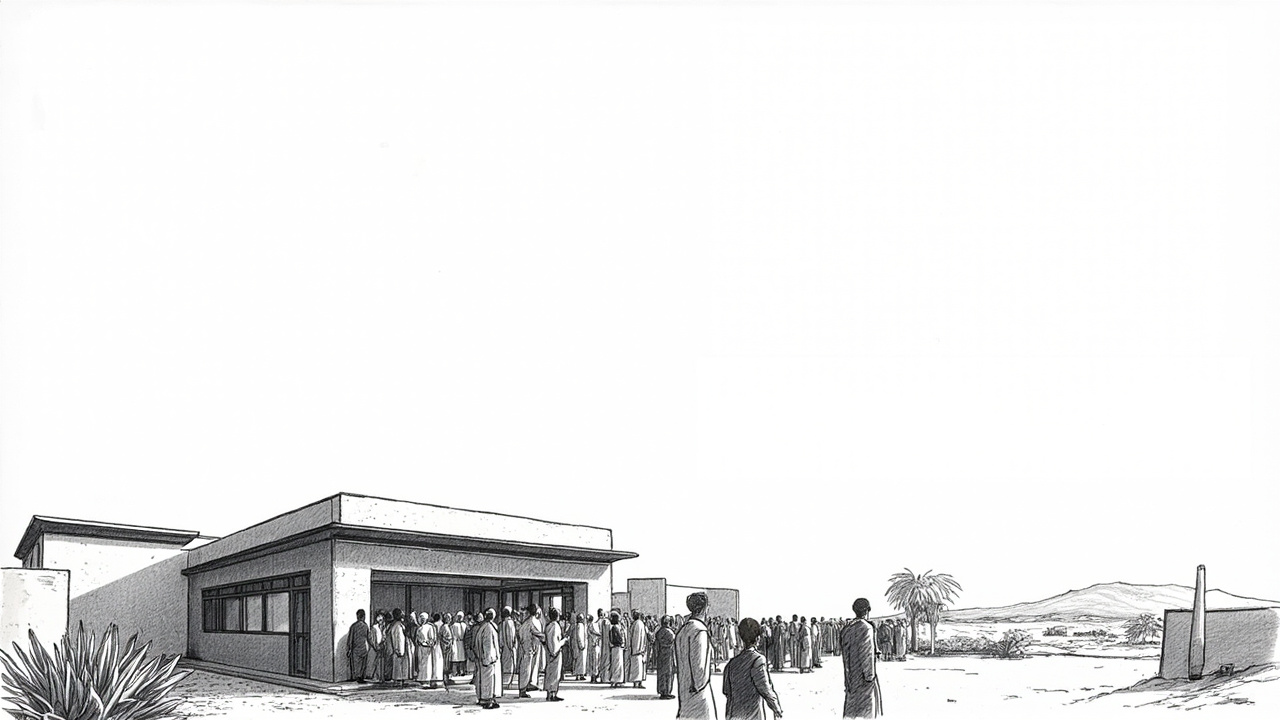

The Central Bank of West African States (BCEAO) opened its auxiliary agency in Tahoua on February 14, 2026. This move signals deeper regional banking integration as Senegal markets watch Niger's commercial hub gain direct central banking access.

Float Management Risk Emerges

Local banks in Niger's Ader region can now process operations directly from Tahoua, located 550 kilometers northeast of Niamey. The concrete implication most outlets miss: rural banking agents will struggle with cash float management. Remote locations typically see 40-60% higher dormant account ratios than urban centers.

Tahoua serves as a commercial, agricultural and pastoral hub. Banks operating there face execution risk from seasonal cash flow volatility. Pastoral communities concentrate transactions during livestock sales periods, creating liquidity crunches.

Cross-Border Payment Pressures Mount

This expansion connects to broader AfCFTA implementation challenges across West Africa. Regional banks need stronger correspondent relationships as trade volumes increase between member states.

The BCEAO's proximity policy aims to serve underbanked regions. Yet KYC enforcement gaps persist in rural areas where identity documentation remains inconsistent. Banks will face regulatory pressure to maintain compliance standards while serving pastoral populations.

Niger's banking sector already struggles with limited agent network coverage outside major cities. Adding Tahoua operations without addressing underlying infrastructure creates sustainability questions.

Interoperability Claims Need Scrutiny

The timing raises questions about Niger's banking strategy amid regional monetary union discussions. Will Tahoua's new status improve actual financial inclusion or simply redistribute existing banking activity?

Rural banking expansion often fails when institutions underestimate operational costs. The BCEAO must prove this branch can generate sufficient transaction volumes to justify ongoing investment.

Payments analysts should monitor whether local establishments actually increase their banking activity or continue relying on informal financial networks. Early transaction data will reveal if this expansion addresses real market demand or represents regulatory box-checking.

Source: Financial Afrik | Analysis: Africa Business News