Nigerian Breweries Revenue Surge Masks Tax Collection Reality

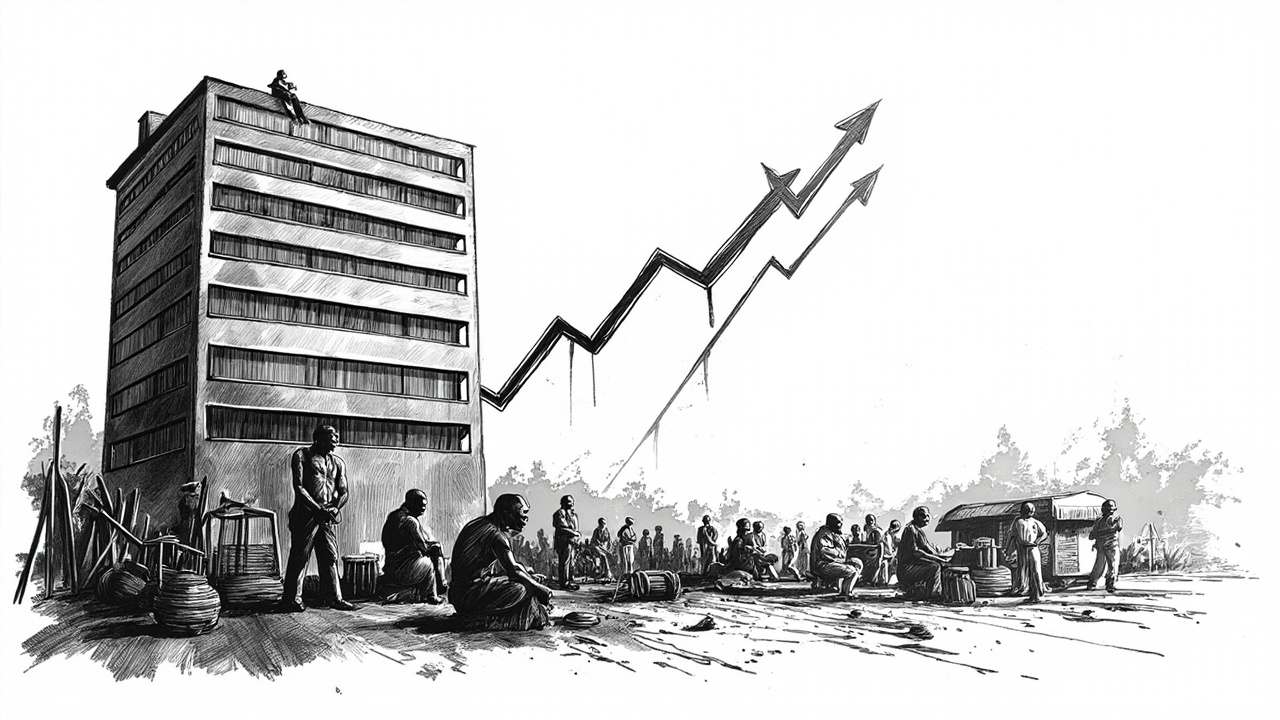

Nigerian Breweries' reported N1.47 trillion revenue for 2025 tells only half the story about Nigeria policy effectiveness and tax collection capacity. While the 35% revenue jump from N1.08 trillion looks impressive, the brewing sector's recovery exposes deeper structural problems in Nigeria's tax system that investors should watch carefully.

The VAT Collection Gap Widens

Nigerian Breweries' dominance becomes clear when you examine the numbers. The company generated N1.05 trillion in just nine months of 2025, representing roughly 68% of the entire brewing sector's N1.54 trillion combined revenue. This concentration creates a dangerous dependency for tax authorities already struggling with collection capacity. The company's 40% reliance on imported inputs means significant foreign exchange outflows, yet VAT refund backlogs continue plaguing manufacturers. When one company drives such outsized tax contributions, any operational hiccup ripples through government revenues. The brewing sector's return to profitability - Nigerian Breweries swung from N149.50 billion losses to N85.51 billion profit - should theoretically boost corporate tax collections. But Nigeria's informal sector remains largely untaxed, meaning formal companies like Nigerian Breweries bear disproportionate compliance costs while competitors in the informal economy operate tax-free.

Compliance Costs Signal Broader Weakness

The sector's recovery masks a troubling reality about Nigeria's tax administration capacity. Rising production costs and inflationary pressures that previously drove Nigerian Breweries into losses haven't disappeared - they've been absorbed through higher prices and operational efficiency. This suggests consumers are paying more while tax authorities struggle to expand their base beyond established formal sector players. International Breweries' parallel recovery - swinging to N57.83 billion profit from prior losses - confirms this pattern affects the entire formal brewing sector.

This recovery built on price increases rather than volume growth signals inflation-driven revenue that may not sustain. Expect tax collection volatility as consumer spending power weakens.