Nigeria Markets Face Hidden Tax Revenue Crisis Behind Naira Slide

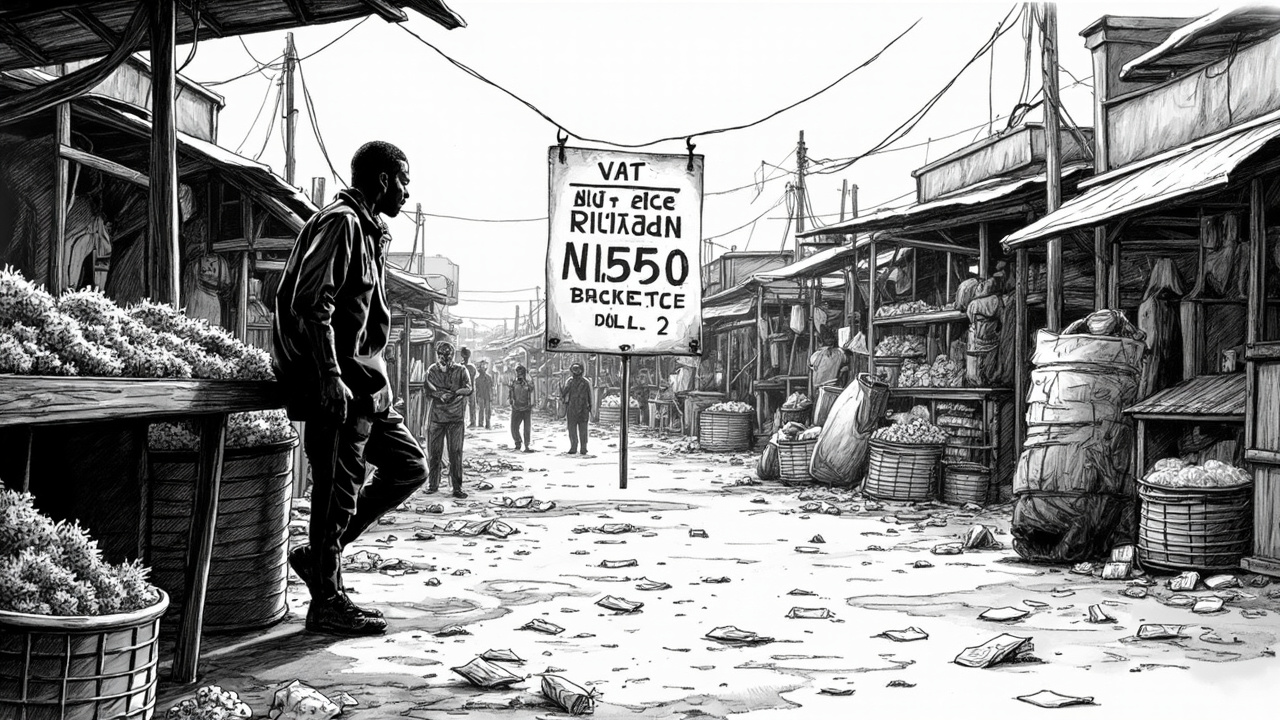

The BMI projection of naira weakness to N1,550/$ by year-end masks a deeper fiscal crisis that Nigeria markets refuse to acknowledge. Currency depreciation directly erodes the government's ability to collect meaningful tax revenue from an economy where 60% of transactions occur in the informal sector. As the naira weakens, small businesses retreat further into cash-only operations, making VAT collection nearly impossible.

The Revenue Collection Death Spiral

Currency instability creates a vicious cycle for tax authorities. Businesses delay invoicing, accelerate import purchases, and shift to barter arrangements to avoid naira exposure. The Federal Inland Revenue Service already struggles with a tax-to-GDP ratio below 6% - among Africa's lowest. Naira depreciation to N1,550/$ will push more economic activity underground, shrinking the formal tax base precisely when government needs revenue most.

VAT refund backlogs, already stretching 18 months for exporters, will worsen as government cash flow tightens. Manufacturing companies like Dangote Cement and BUA Foods face mounting compliance costs while waiting for refunds that may never arrive. The informal sector - from Lagos market traders to Kano textile merchants - will simply opt out entirely.

Ghana's cedi crisis offers a preview. When their currency collapsed in 2022, tax compliance plummeted as businesses hoarded dollars and avoided official channels. Revenue targets became fantasy numbers while the government printed money to fill gaps.

The Amnesty Mirage

Expect another tax amnesty program by Q2 2025 as revenue shortfalls mount. These schemes consistently fail because they reward non-compliance while penalizing honest taxpayers. Previous amnesties collected less than 20% of projected amounts, yet politicians love announcing them.

The real story: Nigeria's tax system cannot function with an unstable currency and massive informal economy. BMI's N1,550/$ forecast signals fiscal collapse disguised as monetary policy. Smart money should prepare for emergency tax measures and capital controls within 12 months.