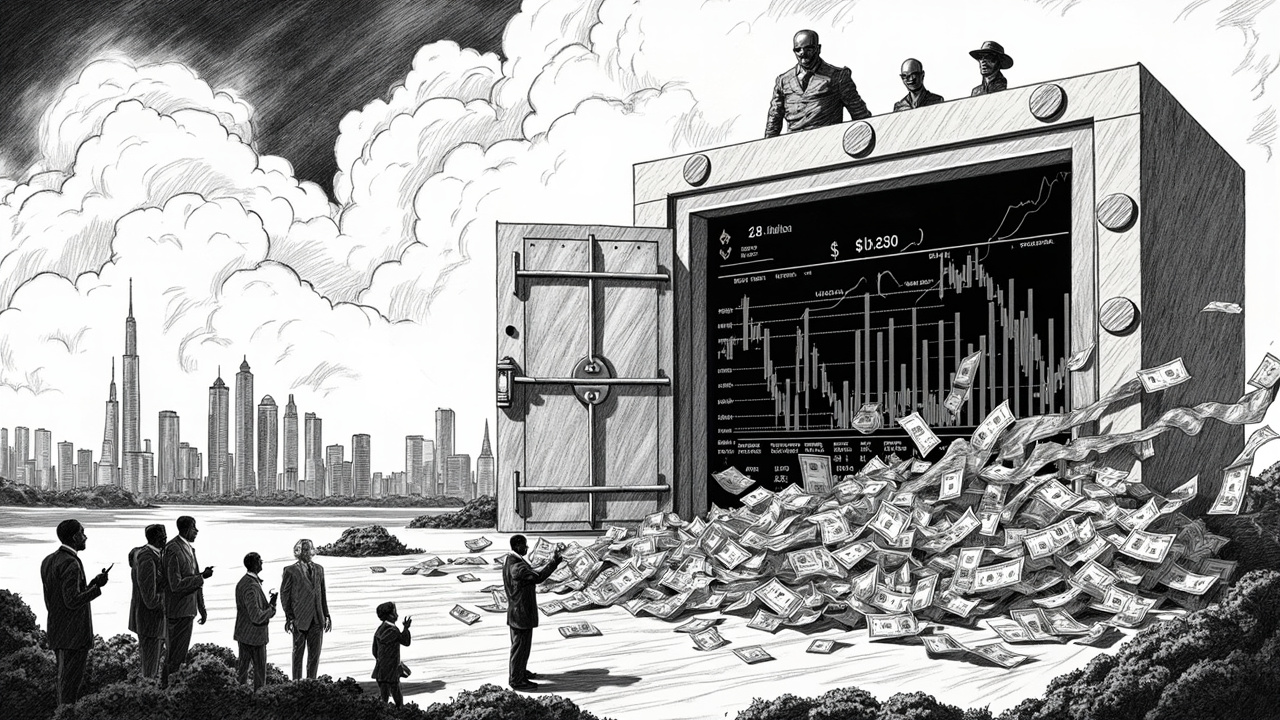

Nigeria Markets Surge Masks Dangerous Portfolio Investment Trap

Nigeria markets celebrated a 380% capital importation surge to $6.01 billion in Q3 2025, but the data reveals a troubling reality for long-term economic stability. This isn't foreign direct investment building factories or infrastructure. Portfolio investment dominated at 80.70% of Q3 inflows, with banking absorbing 52.25% and financing another 30.85%. The numbers tell a stark story: FDI comprised just 4.93% ($296.25 million) of total inflows.

Hot Money Concentration Creates Systemic Risk

Three foreign banks captured 74% of all capital flows: Standard Chartered Bank Nigeria Limited ($2.12 billion), Stanbic IBTC Bank Plc ($1.79 billion), and Citibank Nigeria Limited ($561.40 million). This concentration mirrors 2019's pattern when Central Bank monetary tightening attracted massive portfolio investments into money market instruments. The risk is clear: when global liquidity conditions shift, these flows reverse rapidly. Portfolio investment comprised over 97% of the first nine months' $16.7 billion total, creating dangerous dependence on fickle international capital.

Source countries reinforce this vulnerability. The United Kingdom contributed $2.94 billion (48.80%), the United States $950.47 million (15.80%), and South Africa $773.95 million (12.87%). These are financial centers seeking yield, not strategic partners building productive capacity. Oil and gas, technology, and real estate saw minimal activity despite Nigeria's stated diversification goals.

AfCFTA Integration Remains Hollow Promise

This suggests Nigeria's integration into continental value chains remains superficial. While politicians celebrate headline numbers, the composition reveals continued dependence on external financial markets rather than intra-African trade and investment partnerships. The NBS delayed Q2-Q3 reports by nearly six months, raising transparency concerns precisely when markets need clarity.

Expect volatility when global interest rates shift. Nigeria built a house of cards, not sustainable economic foundations.