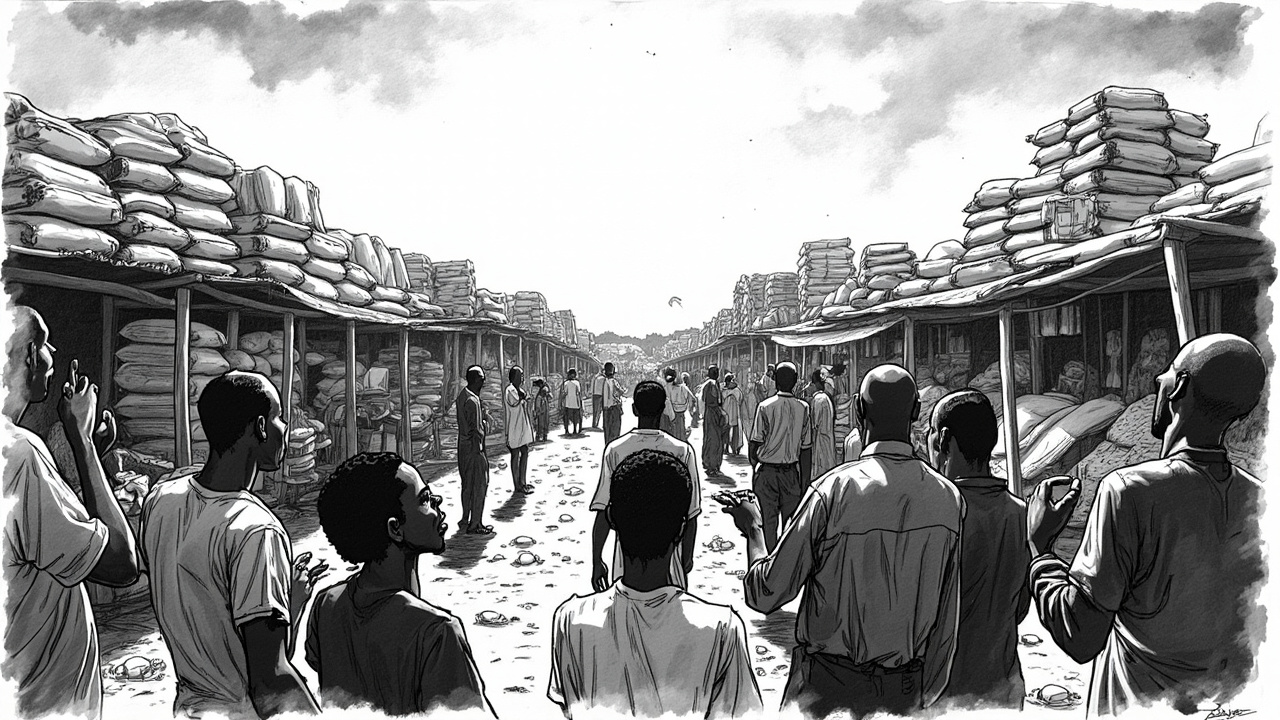

Nigeria Markets Face Tax Confusion as Building Materials Denial Raises Questions

Nigeria's Presidential Fiscal Policy and Tax Reforms Committee rushed to deny claims about a 25% tax on building materials under the Nigeria Tax Act 2025. But the very need for such urgent clarification reveals deeper problems with policy communication in Nigeria markets worth USD 8.82 billion in building materials alone.

Policy Opacity Threatens USD 12.40 Billion Market Growth

The construction sector expects 4.3% growth in 2025, reaching NGN 25.72 trillion. Yet tax policy confusion undermines investor confidence in a market already battling inflation and foreign exchange volatility. The cement and concrete segment dominates the building materials landscape, making any tax uncertainty particularly damaging. This suggests the government's reform communication strategy is failing precisely when clarity matters most. The risk is that international suppliers - currently led by China, Egypt, Turkey, Saudi Arabia, and Germany in the sustainable materials import market - will factor regulatory uncertainty into their pricing. With the broader construction market targeting a 6.4% CAGR through 2029, reaching projected USD 12.40 billion by 2033, mixed signals on tax policy could derail growth momentum.

AfCFTA Integration Suffers From National Policy Chaos

Nigeria's tax reform confusion exposes a fundamental problem with continental integration. How can the AfCFTA deliver seamless trade when Africa's largest economy cannot clearly communicate its own tax policies? The sustainable building materials import market shows high concentration among foreign suppliers, indicating Nigeria's failure to develop regional value chains. This suggests AfCFTA's promise of harmonized trade policies remains hollow when member states cannot manage basic policy transparency. The risk extends beyond Nigeria - unclear tax regimes in major economies undermine continental trade integration efforts.

Expect more policy clarifications as the Nigeria Tax Act 2025 implementation approaches. Nigeria's construction boom depends on regulatory certainty, not government denials after market confusion.