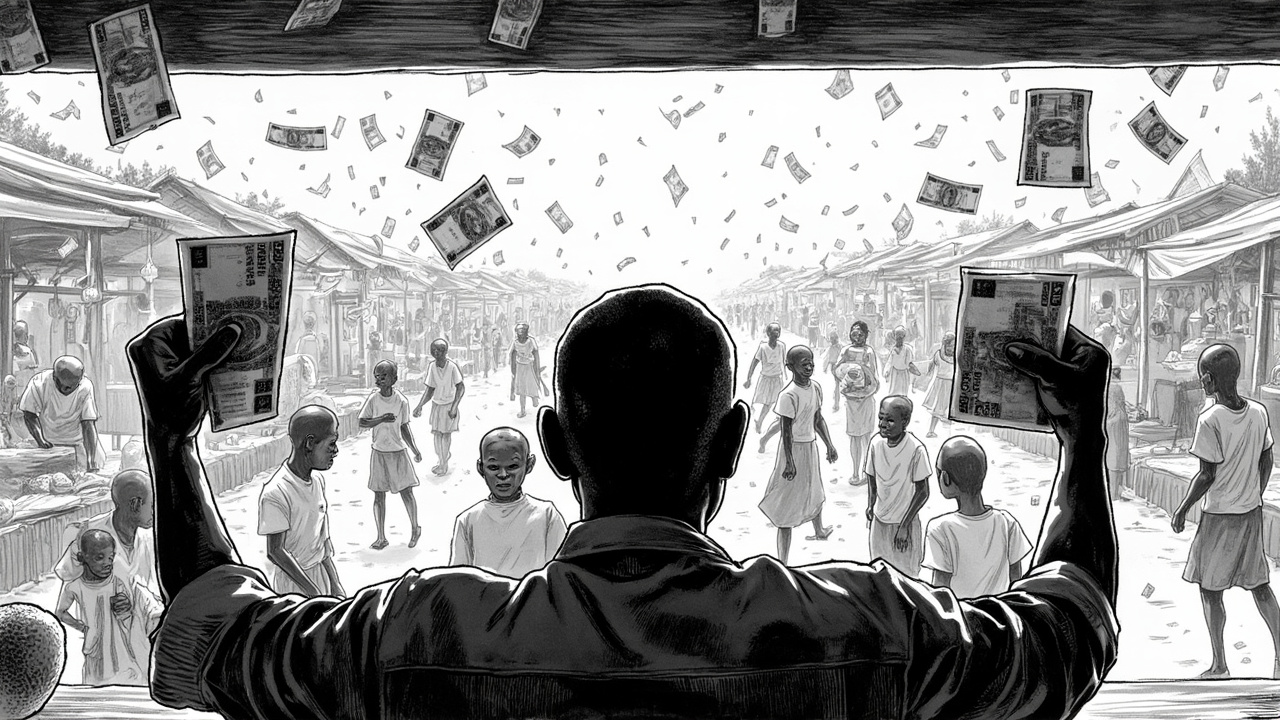

Nigeria Markets Signal Currency Policy Chaos Behind Viral Video

A viral video from Argungu showing a trader accepting everything from pre-colonial cowries to modern naira notes reveals deeper structural problems plaguing Nigeria markets. This isn't charming nostalgia—it's a symptom of monetary policy confusion that should alarm investors.

Informal Sector Adaptation Exposes regulatory Gaps

The trader's willingness to accept historical currencies alongside modern naira demonstrates how Nigeria's informal economy operates outside official monetary frameworks. This suggests the regulatory environment remains so fragmented that market participants create their own rules. The risk is that such practices indicate weak enforcement of currency regulations across the broader economy. When traders feel comfortable publicly accepting non-legal tender, it signals either regulatory absence or selective enforcement—both problematic for institutional investors seeking predictable operating environments. This pattern typically emerges when formal banking systems fail to serve local markets adequately, forcing communities to develop parallel exchange mechanisms. Expect similar currency acceptance practices to spread across Nigeria's vast informal sector, creating additional compliance headaches for formal businesses trying to integrate with local supply chains.

Pan-African Integration Rhetoric Meets Ground Reality

This incident highlights the massive gap between AfCFTA integration promises and actual monetary harmonization progress. While policymakers tout regional currency cooperation, Nigeria's own internal currency acceptance remains chaotic. The contradiction is stark: if a single trader can accept multiple historical currencies within one country, what does this say about prospects for continental monetary coordination? This suggests that grand integration narratives mask fundamental weaknesses in basic monetary policy implementation. African governments consistently oversell their harmonization capabilities while basic currency standardization fails at the local level.

Nigeria's informal sector continues writing its own rules while officials debate continental integration. Investors should prepare for more monetary policy surprises as the gap between official rhetoric and ground reality widens.