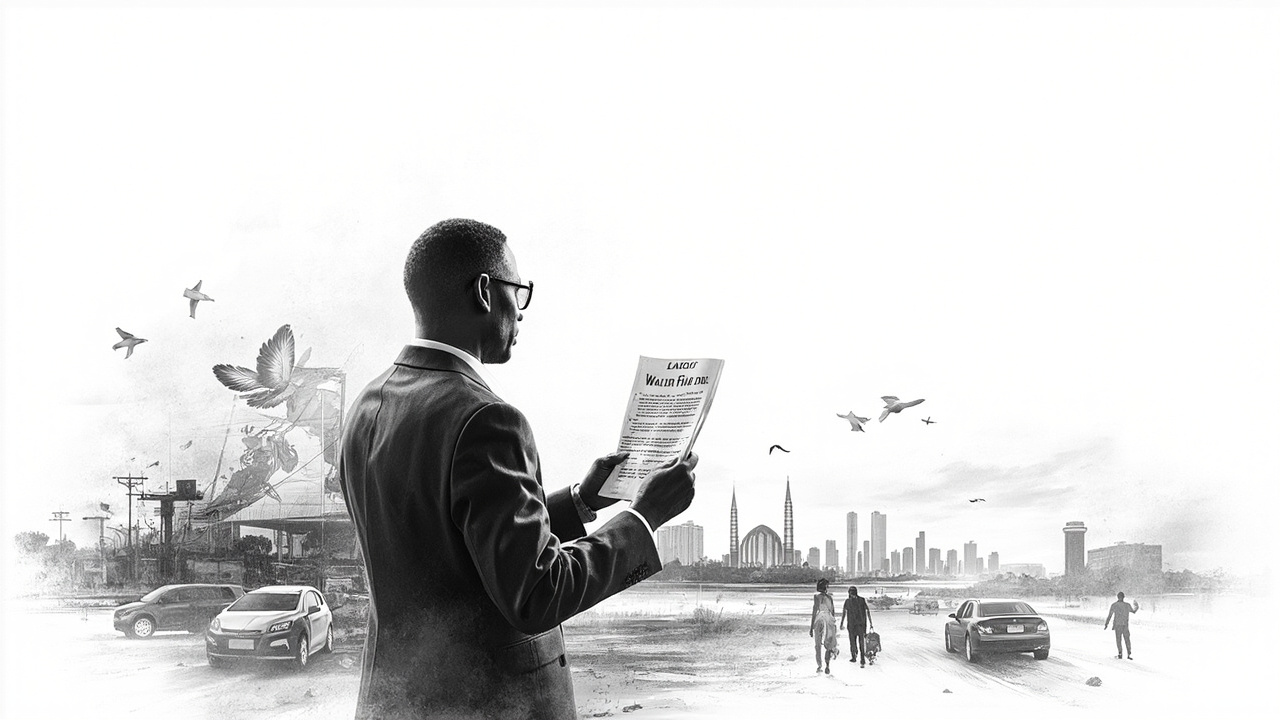

Lagos Wealth Fund: Revenue Reality Check for Nigeria

Lagos State's new Wealth Fund Bill promises sustainable investment and long-term financial stability. Nigeria markets investors should ask harder questions about where the money actually comes from.

Revenue Collection Challenges Behind the Wealth Fund Vision

The Lagos State Government positions its Wealth Fund as a strategic investment vehicle that will transform revenue into long-term wealth through technology innovation and future savings, according to Zawya. This sounds impressive until you examine Lagos's revenue collection reality.

The state's informal sector remains largely untaxed despite generating significant economic activity. Street vendors, small-scale manufacturers, and service providers operate outside formal tax structures. The Lagos Economic Development Update (2025) emphasizes formalizing and scaling small circular businesses for growth and sustainability, per OCCE Lagos. This suggests current formalization efforts haven't captured enough revenue to fund ambitious wealth creation goals.

Without dramatically improved tax compliance, this wealth fund becomes another unfunded mandate. Lagos can't save and invest money it hasn't collected yet.

VAT Refund Backlogs Signal Deeper Fiscal Strain

Wealth funds require consistent surplus revenue. Lagos faces the opposite problem. VAT refund processing delays plague businesses across Nigeria, creating compliance cost burdens that discourage formal sector participation.

The state government's focus on technology innovation within the wealth fund framework suggests recognition of current administrative weaknesses. Digitizing broken processes doesn't fix underlying capacity constraints. The Lagos Private Wealth Conference 2025 brought together high-net-worth individuals and business executives, according to W8 Advisory. These are precisely the taxpayers whose compliance costs matter most for revenue generation.

Infrastructure Investment Reality vs Political Theater

The IFC's investment in Lagos Free Zone demonstrates genuine international confidence in the state's economic potential, with IFC Regional Director Dahlia Khalifa noting their commitment to building infrastructure necessary to attract global and local businesses, per IFC press release.

Private sector infrastructure investment already flows into Lagos through established channels. The wealth fund's infrastructure development mandate risks duplicating existing successful mechanisms while adding bureaucratic layers. Smart investors will question whether Lagos needs another investment vehicle or better execution of current revenue collection.

Lagos needs tax collection reform before wealth fund plans. Without fixing revenue fundamentals, this becomes expensive political theater funded by taxpayers who can't afford the show.