Morocco Retail Surge Masks Consumer Debt Risk During Ramadan

Seasonal Spending Spike Hides Structural Vulnerabilities

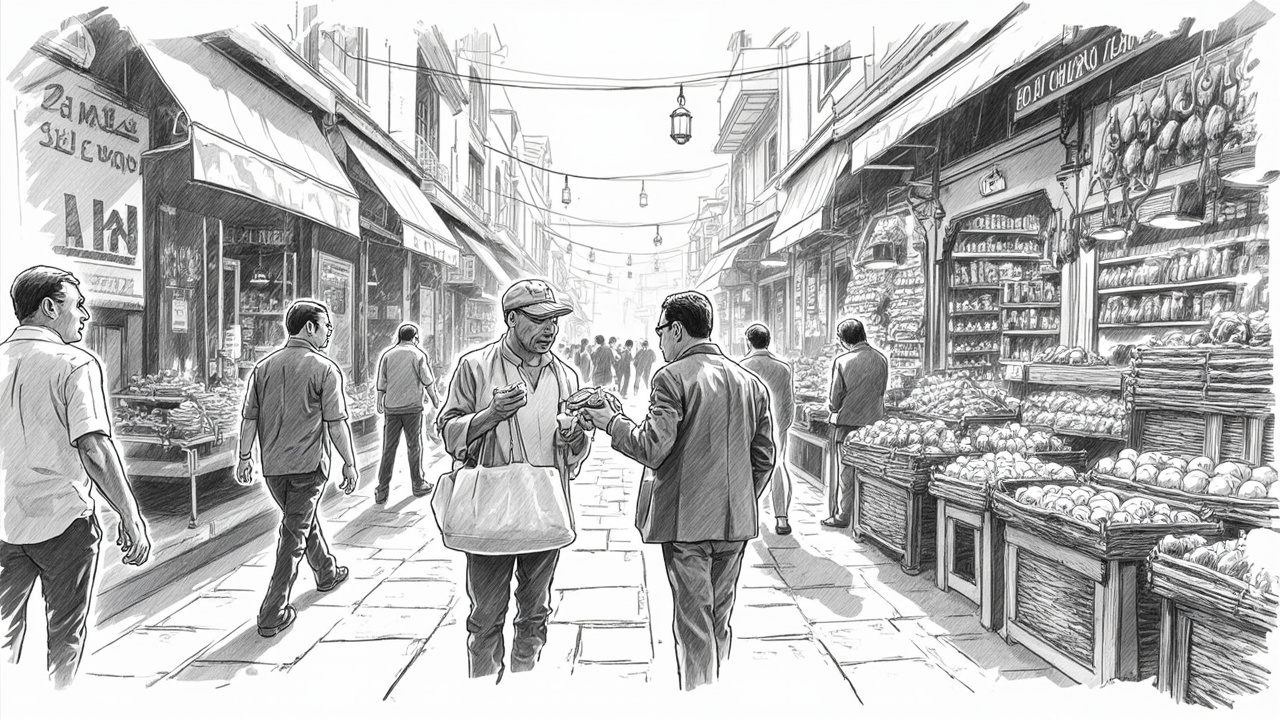

Morocco markets are experiencing their predictable Ramadan consumption surge, with Casablanca's Benjdia district drawing heavy foot traffic as consumers stock up on essentials. But this annual retail bonanza masks a deeper question for investors: how sustainable is consumer spending when it concentrates into a 30-day window?

The Benjdia market activity reflects Morocco's broader seasonal retail pattern, where businesses generate disproportionate revenue during Ramadan's shopping cycle. This creates a cash flow mirage — retailers appear healthy during peak season while potentially burning through capital during the remaining 11 months. For venture-backed consumer companies, this seasonality amplifies runway risk.

Consumer Credit Buildup Creates Hidden Debt Overhang

The intense commercial activity observed in Casablanca suggests consumers are frontloading purchases, likely through increased borrowing or depleted savings. This spending pattern creates potential debt accumulation during peak consumption periods, which could surface in subsequent quarters as household budgets normalize.

Consumer finance companies face concentrated risk exposure as households stretch budgets for traditional celebrations. Consumer-facing startups operating in Morocco should model for post-Ramadan payment delays and potential bad debt increases as spending patterns return to baseline levels.

Operational Burn Rate Acceleration During Peak Season

Retailers and consumer brands face a paradox during Ramadan: revenue peaks while operational costs surge. Inventory financing, extended operating hours, and increased staffing requirements can actually worsen unit economics despite higher sales volumes. Evening shopping patterns require premium labor costs that eat into gross margins.

The risk is particularly acute for venture-backed companies that mistake seasonal revenue spikes for sustainable growth. Founders raising capital during or immediately after Ramadan may present inflated metrics that don't reflect normalized demand patterns. Investors should demand extended data periods to smooth seasonal volatility before making valuation decisions.

Post-Ramadan Reality Check Looms

The bustling markets in Benjdia represent both opportunity and warning for Morocco's retail ecosystem. While the strong availability of essential products and animated commercial activity demonstrate the sector's capacity to meet seasonal demand, they also highlight the compressed nature of consumer spending cycles.

Moroccan consumer companies will face their real test in the months following Ramadan — when household budgets tighten and operational costs normalize. The transition from peak season activity to regular consumption patterns typically reveals which businesses have built sustainable models versus those dependent on seasonal cash injections.

Strategic Implications for Investors

The Ramadan retail surge offers valuable insights for investors evaluating Moroccan consumer plays. Companies that can maintain healthy unit economics during both peak and off-peak periods demonstrate stronger fundamentals than those showing dramatic seasonal swings.

Smart investors will look beyond the impressive foot traffic and commercial animation visible in districts like Benjdia to understand underlying business sustainability. The key metrics to monitor include inventory turnover rates, working capital management, and customer acquisition costs across different seasonal periods.

For venture capital firms, the Ramadan period presents both opportunity and trap. While deal flow may increase as companies show strong seasonal performance, due diligence must account for the cyclical nature of Moroccan consumer spending. Companies that can demonstrate consistent performance across multiple seasonal cycles present more attractive investment opportunities.

Market Dynamics Beyond the Headlines

The strong product availability and market animation in Casablanca's commercial districts reflect broader supply chain resilience and retail infrastructure development. However, this surface-level health may mask underlying vulnerabilities in consumer balance sheets and business model sustainability.

As Morocco's retail sector continues evolving, the annual Ramadan test serves as a crucial benchmark for separating sustainable businesses from those riding seasonal waves. The coming months will reveal which companies built lasting value versus those dependent on concentrated consumption periods.