Safaricom M-Pesa Business Loans Signal Credit Risk Shift

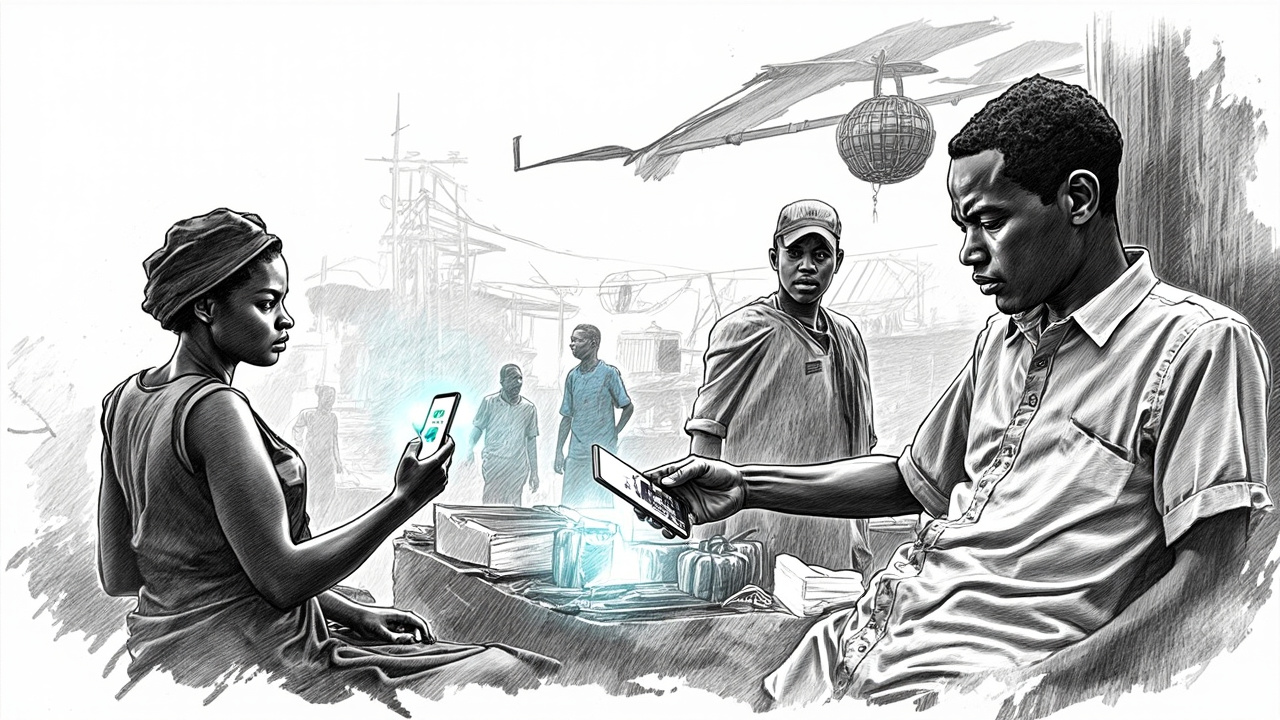

Kenya tech giant doubles down on informal sector lending

Safaricom's M-Pesa Business lending platform, launched May 21, 2025, represents a calculated bet on Kenya's 7.4 million MSMEs, but the real story is what happens when transaction data replaces traditional credit assessment. The platform offers three products: Fuliza Biashara overdrafts up to KES 400,000, and both Taasi Till and Taasi Pochi loans ranging from KES 1,000 to KES 250,000, according to TechTrends Kenya.

CEO Peter Ndegwa's claim about 9% interest rates undercutting commercial banks sounds investor-friendly, but the math tells a different story. These are short-term facilities, Fuliza Biashara runs just 24 hours, where annualized rates can spike well above traditional bank lending. The Central Bank of Kenya's regulatory sandbox approval suggests even CBK recognizes this sits outside normal banking parameters.

Credit assessment gamble exposes regulatory gaps

The platform's core innovation, using M-Pesa merchant transaction data instead of collateral, creates a massive blind spot. Safaricom's own analysis acknowledges most target businesses "operate on cash or M-PESA with no documented transaction history for bank loans." Translation: they're lending to businesses banks won't touch, using data banks don't trust.

This matters because Kenya's MSME sector contributes 40% of GDP but only 20% have formal credit access. That gap exists for reasons, informal businesses carry higher default risk, seasonal volatility, and limited recovery options. Safaricom is essentially betting its M-Pesa transaction algorithm can price risk better than Kenya's entire banking sector.

The partnership with KCB Bank Kenya for Fuliza Ya Biashara suggests even Safaricom needs traditional banking infrastructure for larger exposures. Regulatory approval dependencies for related fintech deals indicate CBK is watching this experiment closely.

Pan-African fintech reality check

Safaricom's move exposes the gap between mobile money success stories and actual financial inclusion. While M-Pesa gets praised across Africa as a model for replication, the lending component reveals the limits. Transaction data from mobile payments doesn't automatically translate to creditworthiness, it just creates a different type of information asymmetry.

This has implications beyond Kenya. As other African mobile operators eye similar lending products, they're inheriting the same fundamental risk: using payment flow as a proxy for business viability. The informal sector's cash-heavy operations mean M-Pesa captures only part of the financial picture.

Expect defaults to cluster around seasonal businesses, supply chain disruptions, and economic shocks that don't show up in transaction patterns until it's too late. The real test comes when Kenya hits its next economic downturn and these algorithm-approved loans start souring simultaneously. Safaricom's betting its data science can outperform traditional credit officers who actually visit businesses and assess operations firsthand.