Ghana Markets Face Hidden Payment System Strain as Fuel Costs Surge

Ghana markets are witnessing petroleum price floors jump to GH¢10.24 for petrol and GH¢11.34 for diesel in the National Petroleum Authority's latest February window. But the real story lies in what these increases mean for the country's fragile digital payment infrastructure.

Agent Network Liquidity Crisis Brewing

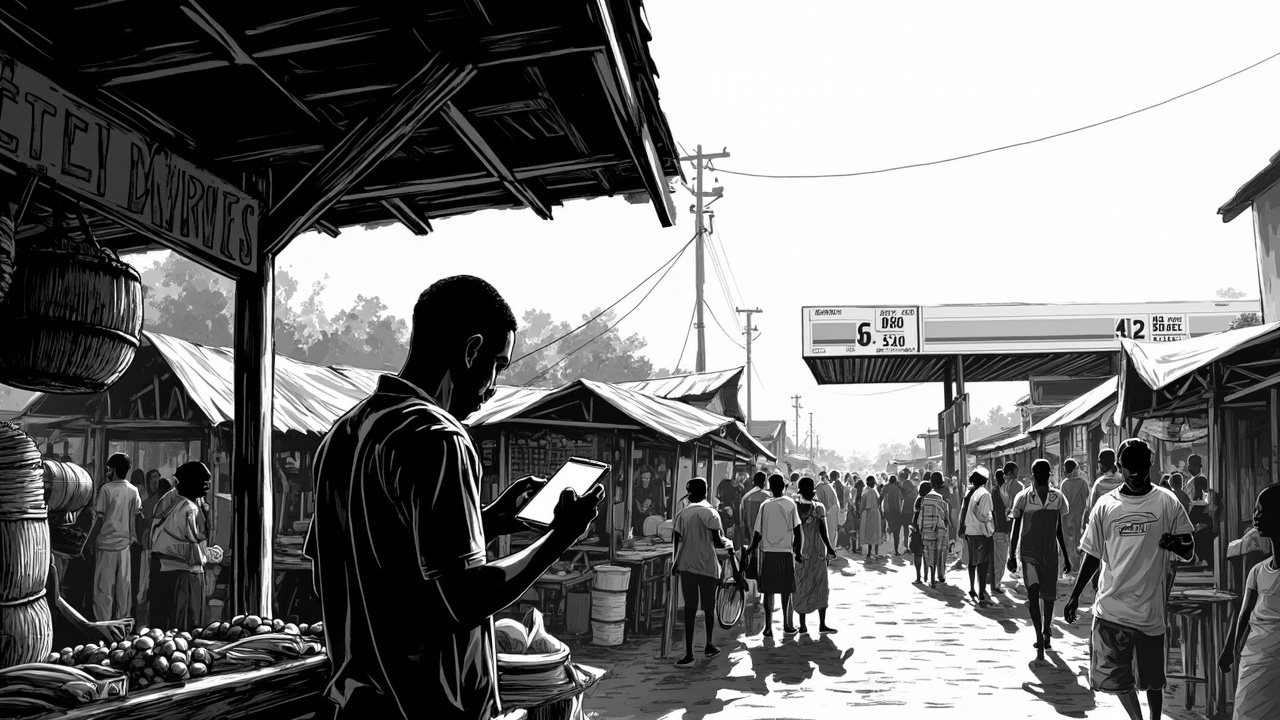

The 4.17% petrol increase and 5.57% diesel surge creates immediate pressure on mobile money agent networks across Ghana. These agents operate on razor-thin margins, typically holding limited float to manage daily transactions. When fuel costs spike, transportation expenses for cash-in-cash-out operations rise proportionally. This suggests agent profitability will compress, forcing many to reduce service hours or abandon remote locations entirely.

The timing compounds the problem. With the Fufex30 rate at GHS11.2000/USD in January's pricing window, currency volatility already strained agent float management. Many agents lack sophisticated hedging mechanisms, leaving them exposed to both fuel cost increases and exchange rate fluctuations. The risk is widespread service degradation in rural areas where agents serve as the primary financial access point.

KYC Enforcement Will Weaken Under Cost Pressure

Higher operational costs create perverse incentives for compliance shortcuts. Agents facing margin compression will prioritize transaction volume over proper know-your-customer procedures. This suggests dormant account ratios could spike as agents rush through verification processes to maintain throughput.

Ghana's oil and gas sector shows sustained growth, but the three-year rising trend ended in a market decrease during 2025, indicating underlying volatility. Key operators like Kosmos Energy Ghana HC and GNPC face production uncertainties that will continue feeding price instability. Interoperability claims from payment providers ring hollow when the underlying agent economics don't support consistent service delivery.

Expect widespread agent network consolidation within six months. Rural financial inclusion will retreat significantly.