Funding Cuts Threaten Ethiopia's HIV Treatment Programs

External Aid Reductions Disrupt HIV Services in Ethiopia

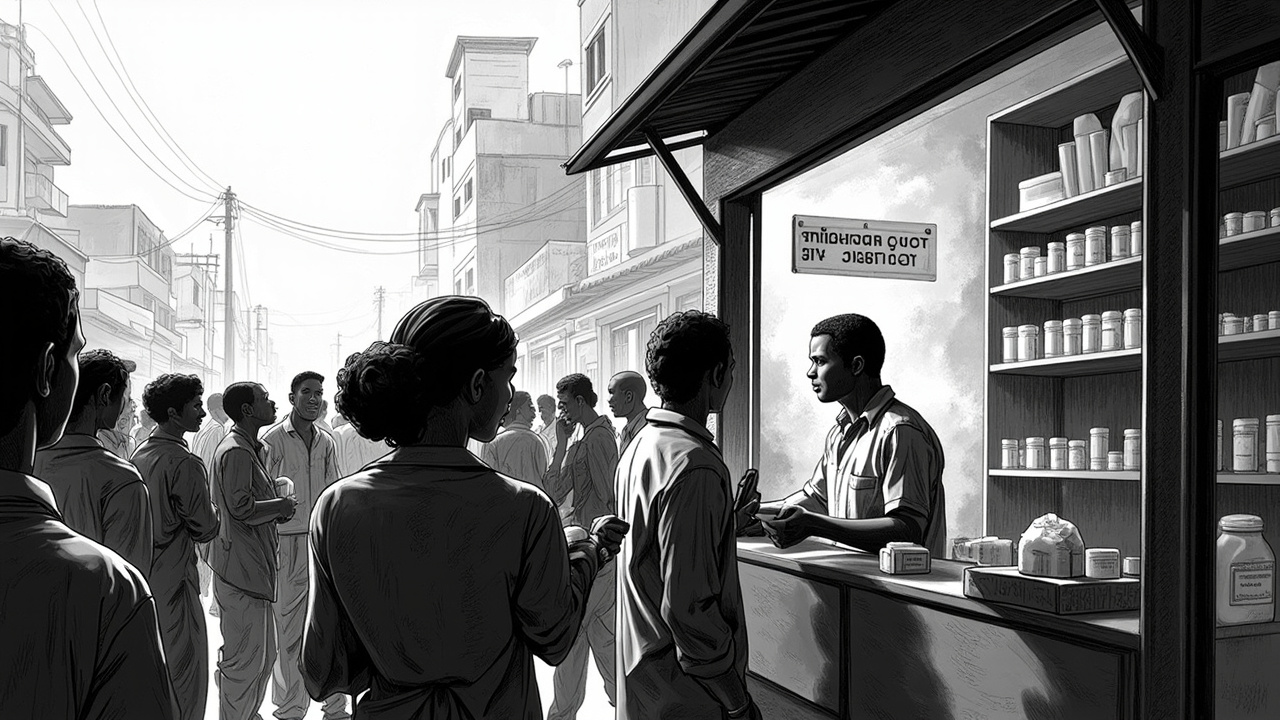

Major funding cuts from international donors are disrupting HIV treatment programs across Ethiopia. The Global Fund to Fight AIDS and the United States government have both reduced their financial commitments for 2025. These reductions directly affect medication supplies, testing services, and patient support systems throughout the country.

Ethiopia's health ministry reports that external funding previously covered approximately 70% of the national HIV response. The Global Fund alone contributed $120 million USD (6.9 billion Ethiopian Birr) annually before the cuts. U.S. government support through PEPFAR programs added another $85 million USD (4.9 billion Ethiopian Birr) each year.

Health facilities in Addis Ababa, Dire Dawa, and Bahir Dar are already experiencing medication shortages. Some clinics report 30% reductions in antiretroviral drug supplies. Testing centers have reduced operating hours by 40% in several regions. These service disruptions affect an estimated 450,000 Ethiopians currently receiving HIV treatment.

Why It Matters for Ethiopia's Health System

HIV treatment interruptions create immediate health risks and long-term economic consequences. When patients cannot access consistent medication, viral loads increase. This leads to more severe illness and higher transmission rates. The World Health Organization notes that treatment interruptions can reduce medication effectiveness by up to 60%.

Ethiopia's health system faces multiple challenges simultaneously. The country recorded 15,000 new HIV infections in 2023. Treatment adherence rates have historically been strong at 85%. Funding cuts threaten to reverse this progress. Health Minister Dr. Lia Tadesse stated that the government is exploring alternative financing options.

Private healthcare providers are also affected. Companies like Tikur Anbessa Specialized Hospital and St. Paul's Hospital Millennium Medical College rely on donor-funded programs. These institutions provide specialized HIV care to thousands of patients annually. Service reductions could increase pressure on Ethiopia's already strained public health infrastructure.

Business Implications in Ethiopia's Healthcare Market

Pharmaceutical companies face immediate market changes. Local manufacturers like Addis Pharmaceutical Factory and Ethiopian Pharmaceutical Supply Service must adjust production schedules. International suppliers including Cipla and Mylan have reduced shipments by 25% in recent months. These changes affect procurement contracts worth approximately $50 million USD (2.9 billion Ethiopian Birr) annually.

Healthcare staffing patterns are shifting. Organizations like the Ethiopian Public Health Institute report that 15% of HIV program staff have been reassigned. Some positions have been eliminated entirely. This affects employment stability for approximately 2,000 healthcare workers across the country.

Insurance providers are monitoring the situation closely. The Ethiopian Insurance Corporation and private insurers like Nyala Insurance face potential claims increases. Untreated HIV cases often lead to more expensive hospitalizations. Insurance industry analysts project a 20% increase in related healthcare claims if treatment disruptions continue.

What Businesses Should Watch

Monitor government procurement announcements. Ethiopia's Ministry of Health will issue new tender documents for HIV medications in the coming months. These contracts typically range from $30-50 million USD (1.7-2.9 billion Ethiopian Birr). Pharmaceutical companies should prepare competitive bids that address current funding constraints.

Track regulatory changes. The Ethiopian Food and Drug Administration may expedite approval processes for generic medications. This could reduce costs by 40-60% compared to branded drugs. Companies with existing generic portfolios have a potential advantage in this changing market.

Watch for public-private partnership opportunities. The government is exploring alternative financing models. These might include performance-based contracts or social impact bonds. Healthcare providers and pharmaceutical companies should develop proposals that demonstrate cost-effectiveness and measurable outcomes.

Observe workforce mobility patterns. Healthcare professionals may seek employment in more stable sectors or countries. This could create staffing shortages that affect service delivery. Companies relying on medical expertise should consider retention strategies and training programs.

Note infrastructure investment opportunities. The government may prioritize domestic pharmaceutical manufacturing capacity. Ethiopia currently imports 80% of its medications. Local production facilities could receive tax incentives or subsidized loans. Industrial zone developments in Bole Lemi and Kilinto offer potential locations for such investments.

Ethiopia's Response Strategy

The Ethiopian government is implementing several measures to address funding gaps. Health officials are reallocating approximately 15 billion Ethiopian Birr ($260 million USD) from other health programs. This represents about 12% of the total health budget. The reallocation will support essential HIV services for the next six months.

International organizations are providing technical assistance. The World Bank approved a $300 million USD (17.3 billion Ethiopian Birr) health system strengthening loan in January 2024. This funding supports broader health infrastructure but includes provisions for HIV program integration.

Local pharmaceutical companies are increasing production capacity. Addis Pharmaceutical Factory plans to expand its antiretroviral manufacturing by 30% within 18 months. This expansion requires approximately 500 million Ethiopian Birr ($8.7 million USD) in new equipment and facility upgrades.

Community organizations are mobilizing additional resources. The Ethiopian Red Cross Society launched a fundraising campaign targeting diaspora communities. The campaign aims to raise 2 billion Ethiopian Birr ($34.5 million USD) over two years. These funds would support medication purchases and patient transportation services.

Market Outlook and Next Steps

Healthcare investors should monitor several key indicators. Watch for changes in medication import volumes through Ethiopian Customs Commission data. Track patient retention rates in quarterly health ministry reports. Observe pharmaceutical stock levels at central medical stores in Addis Ababa and regional hubs.

Businesses should prepare for potential market shifts. Pharmaceutical companies might need to adjust pricing strategies for the Ethiopian market. Healthcare providers could explore telemedicine options to maintain patient contact. Insurance companies should update risk models to account for potential health system strain.

The situation requires careful monitoring throughout 2024. Funding decisions by major donors will become clearer by the third quarter. Ethiopia's domestic response will demonstrate the health system's resilience. Market participants should maintain flexibility while supporting essential health services during this transition period.